Terms Sheets 101: Drag Along Rights

Introduction

Drag-along rights are one of the common clauses in term sheets, that allow majority shareholders to force the remaining minority shareholders into a prompt sale. But this is based on the requirement that minority shareholders get similar terms and conditions like majority shareholders.

After equity distribution between shareholders like the investors and founders, drag-along rights come into play. The idea is to ensure majority shareholders are able to negotiate a proper exit. Typically, drag-along rights work side-by-side with tag-along rights that protect the minority shareholders’ interests to exit.

Drag-Along Rights Fundamentals

Drag-along rights are there to protect the company’s majority shareholders during a liquidation event. In most cases, majority shareholders want to exit the company in the event of a merger or acquisition. Drag-along rights allow majority shareholders to bring minority shareholders into the fold and force the sale of a company, assuming they get the same terms as majority shareholders.

While dissenting minority shareholders are not very common in most of the deals, and in regular day-to-day business affairs, any potential buyer of the business will want to acquire the full stake of the company, and will be put off if they cannot gain 100% control.

At its core, drag-along rights serve as control provisions that protect majority shareholders from unscrupulous decisions or minority shareholders blocking a deal to sell the business.

Technically, drag-along rights require a major shareholder to vote for the sale of the company. The transaction gets approved based on a specific percentage of board members of stockholders. It is important to note that these control provisions expire once the company goes in for an IPO.

[monsterinsights_popular_posts_inline]

Drag Along Rights: An Example

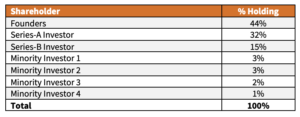

Assume that the a Dunzopia, a tech startup has the following cap table:

Dunzopia has now received an acquisition offer from a strategic investor. The Board is aligned, and the company is valued at $100 million. All investors in the cap-table are aligned except Minority Investor 2, and Minority Investor 4. They believe that the company is undervalued, and are being forcefully acquired by the strategic investor.

There are three scenarios:

Scenario #1: No Drag Along Rights In the Shareholders’ Agreement

Even though all the majority investors are aligned with the terms of the deal, the deal could be stopped by Minority Investor 2, and Minority Investor 4.

Scenario #2: The Shareholder Agreement Has The Following Drag Along Rights

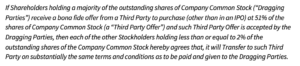

The Shareholder Agreement has the following clause:

In this clause, there are three aspects:

- First – There has to be an offer from a third party to acquire a majority stake

- Second – The majority shareholders should agree to the terms and conditions of such acquisition offer

- Third – Any shareholder holding less than or equal to 2% of the outstanding shares will be obliged to consent

In this example, the dissenting shareholders are:

- Minority Investor 2 – Holding 3%

- Minority Investor 4 – Holding 1%

Applying the drag-along clause, Minority Investor 2 cannot be forced to sell (holds more than 2%). However, Minority Investor 4 will be dragged along, since he/she holds less than 2% of the outstanding shares.

Therefore, unless Minority Investor 2 consents to the acquisition offer, the deal cannot go through.

Scenario #3: The Shareholder Agreement Has The Following Drag Along Rights

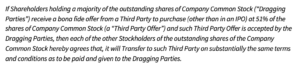

The Shareholder Agreement has the following clause:

In this case, since there is no threshold defined for the trigger of the drag-along right, both Minority Investor 2 and Minority Investor 4 will be dragged along.

Importance and Mechanics of Drag-Along Rights

From the perspective of potential buyers, drag-along rights make the deal more attractive. And that’s because buyers often prefer to have complete control over the target company. Drag-along rights ensure that the minority shareholders sell their shares along with the other shareholders.

However, this agreement has to be on mutual terms between the majority and minority shareholders. This clause is crucial to ensure minority shareholders don’t block the sale of a company, which would make it more challenging for new company owners to take full control. Failure to adhere to this clause sometimes tanks the entire deal.

In the event of a merger or acquisition, companies want 100% control and ensure complete ownership. Drag-along provisions support, affirm, and speed up the sale of the company between two parties.

[monsterinsights_popular_posts_inline]

Considerations and Attributes of Drag-Along Rights

Drag-along rights revolve around the following characteristics:

- Minimum Price: Although not very common, investors could set the minimum price, terms and conditions, for the drag-along clause to kick-in.

- Minimum Threshold: Investors determine the percentage that may set off drag-along provisions. Usually, shareholders holding less than 2% could be subject to the drag-along clause.

- Representation and Warranty Exemptions: The parties being dragged along could exempt themselves from the representations and warranties of the sale transaction.

- Liquidity Qualifiers: Drag-along rights could be drafted in such a way that they kick-in only in case of exchange of liquid assets (such as cash or stock of a listed company). In this case the sale price is settled with a share swap of a private acquirer, this may not trigger the drag-along rights.

Enforceability of Drag Along Rights in India

Drag-along are relatively new to the Indian community. In the erstwhile Companies Act of 1956, these rights were practically unenforceable. This is because Section 111A of the Act required shares of a company to be ‘freely transferable’.

Therefore any drag-along or tag-along rights (i.e. where minority shareholders can tag along with the majority) were contradictory to these provisions and construed as causing a restriction in the free transferability.

However, the major turning point was in the matter of Messer holdings v Shyam Madanmohan Ruia, settled at the Bombay High Court. The Court held that any contract or arrangement between two or more persons with respect to transfer of securities can be enforced. It also held that such clauses in the shareholders’ agreement does not impede the free transferability of shares.

Because of these practical difficulties, the Companies Act of 2013, inserted a new proviso to Section 58(2) which enforced “any contract or arrangement between two or more persons in respect of transfer of securities”. This meant that any drag-along or tag-along right in the Shareholders’ Agreements were enforceable by law

Enforceability of Drag Along Rights in the UK

In the UK, Drag-along and Tag-along rights are widely used and accepted as a standard clause in Shareholder Agreements. The legal recognition for these rights is formally available in Growth and Infrastructure Act, 2013. If the enforceability of these rights is challenged, the Courts in UK have scrutinised the facts and circumstances of the case and given judgements accordingly. In Cunningham v Resourceful Land Limited the Courts upheld the drag-along clause, and that the rights were exercised in good faith.

[monsterinsights_popular_posts_inline]

When Drag-along Rights are Triggered

Drag-along rights are set off when different kinds of sale transactions like mergers or acquisitions are involved. If there’s an expected change in control of the organisation, it will also trigger drag-along rights. Depending on the firm’s ownership and negotiation parameters, the percentage of shares of majority shareholders can vary.

Typically, this percentage is between 51% and 75%. Some shareholders, like angel investors or venture capital investors, might want to limit to make drag-along provisions conditional. Similarly, these shareholders may also want to add certain exceptions.

Who Can Trigger The Drag-Along Rights

The drag-along rights are usually triggered by the majority shareholders. If these rights exist in the Shareholders’ Agreement, then the agreement usually lays down the methodology by which these can be triggered. In such cases the minority shareholders are required to vote in favour of the transaction or acquisition.

In Halpin v. Riverstone National, Inc. the majority shareholders caused the company to complete the merger, but did not trigger the drag-along rights. After receiving the sale terms, the minority shareholders filed a suit, because the drag-along rights were not properly exercised. The Delaware Court of Chancery held that since the drag-along rights were not exercised properly, the minority shareholders were not obliged to vote in favor of the merger.

[monsterinsights_popular_posts_inline]

Key Points to Remember

- When reviewing a drag-along clause, it is important to make sure that the dragged along party will receive the same terms of the deal as approved by the majority shareholders. If the clause is disputed by the minority holders, there is a great chance that a court will find it is enforceable and fair to both parties.

- The drag-along clause should be as wide as possible so that it gives greater flexibility. For example, when trying to define different types of considerations, a catch-all phrase such as “… and any other consideration” is advised.

- If your startup does not have any drag-along provisions, you should consider passing an amendment to your articles, and include them in a separate Shareholders’ Agreement. This way, any exit does not get blocked by the minority.

Final Thoughts

Whether you’re a minority or majority shareholder, structure drag-along rights usually work in the best interests of both parties.

Drag-along rights ensure ultimate goals of founders and investors are realized and lead to a successful exit. Drag-along rights are indeed a benefit to the minority shareholders.

On the surface, drag-along rights may seem complex, and that’s fair. But entrepreneurs and business owners should have a proper understanding of drag-along rights when negotiating a deal. You can consult lawyers or have a Virtual CFO on board to help you negotiate and find answers to difficult questions. The trick is successfully navigating these elements and creating a balance between founders and investors.