How to Value a Startup Company with No Revenue

Valuing startups with no revenue can be challenging, both for the investors and the founders. There are many things that come into play, such as the size of the opportunity, founding team, product, and marketing risks.

In many cases, valuation of startups is more of an art than science. You just cannot arrive at a precise number, using any of the so-called “scientific valuation methodologies”.

It is for this reason that many entrepreneurs have this question “how to value a pre-revenue startup”

In this article we look at the different startup valuation methods, with a focus on pre-revenue valuation methods

Why Is Start-up Valuation Different?

John Maynard Keynes once said, “It is better to be roughly right, than precisely wrong”. According to me, this summarizes the world of valuation.

Business valuation is more of an art than a science. This principle holds good in the case of pre-revenue startup valuation. Startups need additional investment to keep them going till they cross the J-Curve.

Every round of additional investment needs a valuation exercise by an independent professional. Valuation is subjective, based on certain assumptions, and to a large degree, subject to bias.

Valuing seed stage startups or early-stage startups is particularly hard. Why? Because there is no historical data. Financial projections and proformas are glorified excel spreadsheets.

In many cases, there is no product that has been validated by the market. In such cases, you are only valuing the idea, hoping the founders’ team would pull off the idea successfully.

Mature companies (the likes of Apple, Google) have more hard data and facts to rely upon. Valuing these companies is much easier. Many of these mature companies are valued as a multiple of their EBITDA.

There are some widely accepted startups valuation methods.

How Do Valuations Work?

When you decide to raise capital for your startup, you will essentially receive cash for a fractional ownership of your startup. To determine how much stake, you give to an investor, you need to agree on the valuation of the startup.

Before any investor comes in, the founders own 100% of the startup. When an investor puts in money into a company, the investor buys a partial stake (ownership) in the company.

For example, let’s assume that an investor agrees to invest $500K in your startup. How much ownership stake will you give away?

This can be achieved in three steps:

- Assign a valuation to the Company before the money is infused. This is also called as the pre-money valuation. Let’s assume that your company’s pre-money valuation is $3.5 million

- To the pre-money valuation, add the amount that the investor is putting in. In this case, add $500K. So, the result is $4 million. The result is called the post-money valuation.

- Divide the amount of investment (i.e. $500K) by the post-money valuation to arrive at the stake that the investor gets. In our example, this works out to 12.5%. This is also called as the founder dilution percentage.

This equation shows how the pre-money and post-money valuation add up:

Pre-Money Valuation + Investment Amount = Post-Money Valuation

Investors are generally motivated to lower the pre-money valuation. When the pre-money valuation is lower, the investor gets a higher stake.

So, the question is, how to arrive at the pre-money valuation? Let’s look at some common methods.

[monsterinsights_popular_posts_inline]

Traditional Startup Valuation Methods

Method 1: First Chicago Method

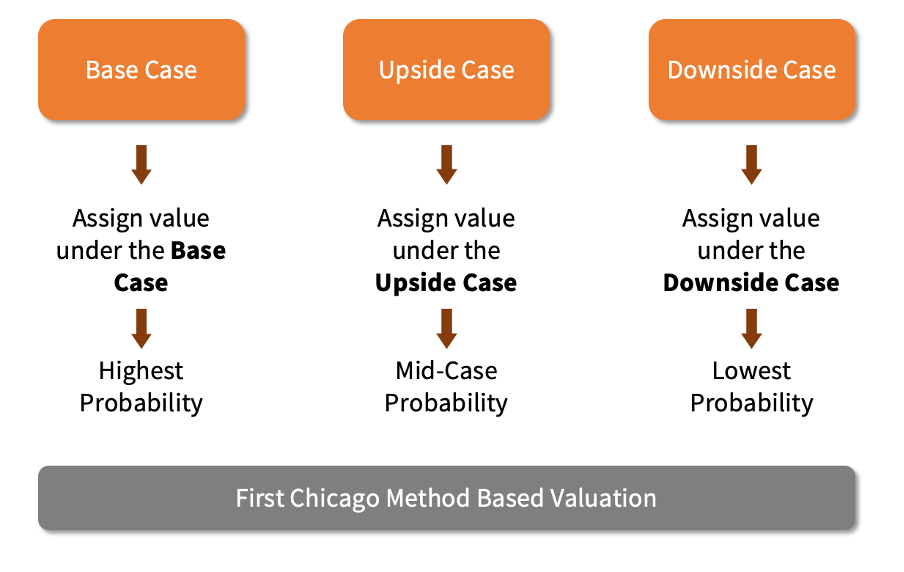

The First Chicago Method is an expectation weighted method of calculating the value of a startup. Usually, to evaluate a startup using this method and three different scenarios are used:

- Base Case: The base case is the most likely outcome where performance meets expectations. Therefore, the highest probability is assigned to the base case.

- Upside Case: The upside case is a scenario where performance exceeds expectations. This is the most optimistic scenario among the three scenarios. This usually takes the second highest probability in all the three scenarios.

- Downside Case: The downside case is a scenario where performance is below expectations. This is the most pessimistic scenario among the three scenarios. This usually takes the lowest probability in all the three scenarios.

Our Take on the First Chicago Method

- The First Chicago Method itself is not a method for valuing startups. It is only a derivative approach, that helps you understand a startup’s value when you have multiple outcome possibilities.

- The First Chicago Method assumes that you already have a base valuation model. This is rarely available for startups because historical data is sparsely available. Many startups use this method is a base valuation is available, under the traditional methods like discounted cash flow.

- This method is rarely useful when the startup has no revenue

Method 2: Berkus Method

In the early 1990s, Dave Berkus first developed this method. The Berkus Method is a simple and a straight-forward model to value a pre-revenue company. This method offers a simple framework for entrepreneurs to compute the valuation of their start-up.

Under this method, a startup is evaluated under five criteria. For each of the criteria, a value of $500,000 is given:

- Sound Idea: A value of $500,000 is given if the business has a sound and an exciting idea.

- Management Team: Another $500,000 is assigned for a quality management team. A quality management team includes founders with previous start-up experience, sound technical knowledge, proven experience and so on.

- Prototype: If the company has a prototype or a Minimum Viable Product (MVP), add another $500,000.

- Strategic Relationships: If the startup has powerful strategic partnerships, then add another $500,000

- Product Sales: Another $500,000 is added if the startup has revenue, or a pathway to revenue (such as confirmed orders/contracts)

The pre-money value of the startup is arrived based on the sum of the above. The theoretical pre-money valuation under this method is $2.5 million.

Our Take on the Berkus Method

- This method was invented in the early 1990s – some of the thought processes behind the model could be outdated.

- The rationale of $500K per criteria is something that needs to be revisited. It is also incorrect to say that the maximum theoretical value of “any” start-up is only $2.5 million

- Dave Berkus in one of his articles has written why some of the variables are no longer valid.

[monsterinsights_popular_posts_inline]

Method 3: Scorecard Valuation Method

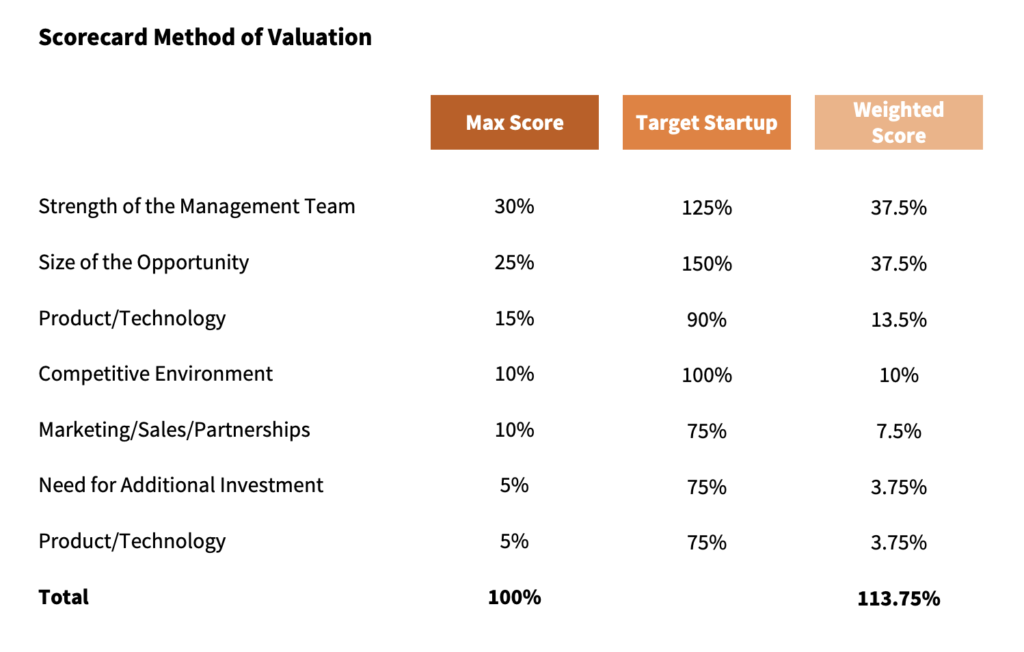

The scorecard method is a method that is commonly used in early-stage angel investments. When investors put money in an early-stage startup, they are often challenged with the need for valuing the startup. Under the scorecard method, investors use different parameters to evaluate the value of the startup.

This method uses “scores” for different parameters, and a benchmark market data to arrive at the valuation of the start-up.

In this method, the target startup is compared to a similarly funded startup. The main criteria for scorecard method are:

- Founders, Board and Advisory Team – 30%

- Size of the opportunity – 25%

- Technology/Product – 15%

- Competitive Environment – 10%

- Marketing/Sales – 10%

- Need for additional financing – 5%

- Others – 5%

Here is an example of the scorecard method of valuation:

If the value of the benchmarked company is $10 million, then the valuation of the target startup is $11.375 million

Our Take on the Scorecard Valuation Method

- Scorecard method is quite popular with some of the angel investors.

- One big challenge from a practical perspective is to identify a benchmark company. Many times, a new idea or a relatively new product does not have any benchmark data.

Method 4: Venture Capital Method

The venture capital method is used in pre-revenue startups, where investors calculate the valuation based on the possible exit value. So, let’s say an investor expects to exit the startup within seven years of their investment.

The valuation of the startup is calculated by working back the exit value to today’s value. The return on investment used for working back the valuation is determined based on the specific risk attached to the investment.

The broad steps involved in the venture capital method are:

- Estimate the current investment needed in the startup

- Build a financial model for the startup

- Forecast the exit timing (such as IPO, acquisition etc)

- Determine the exit multiple (based on comparison with similar companies/exits)

- Determine the risk associated with the investment, and the corresponding required rate of return

- Determine valuation of the startup

Our Take on the Venture Capital Method

- Like other methods, the venture capital methods require building a financial model. Building a financial forecast is usually very hard for pre-revenue startups

- Identifying exit multiples at a future period is challenging, especially in markets where the comps change based on economic cycles.

- Because of the simplicity, this method is widely used as a rule of thumb to arrive at a base valuation.

Method 5: Risk Factor Summation Method

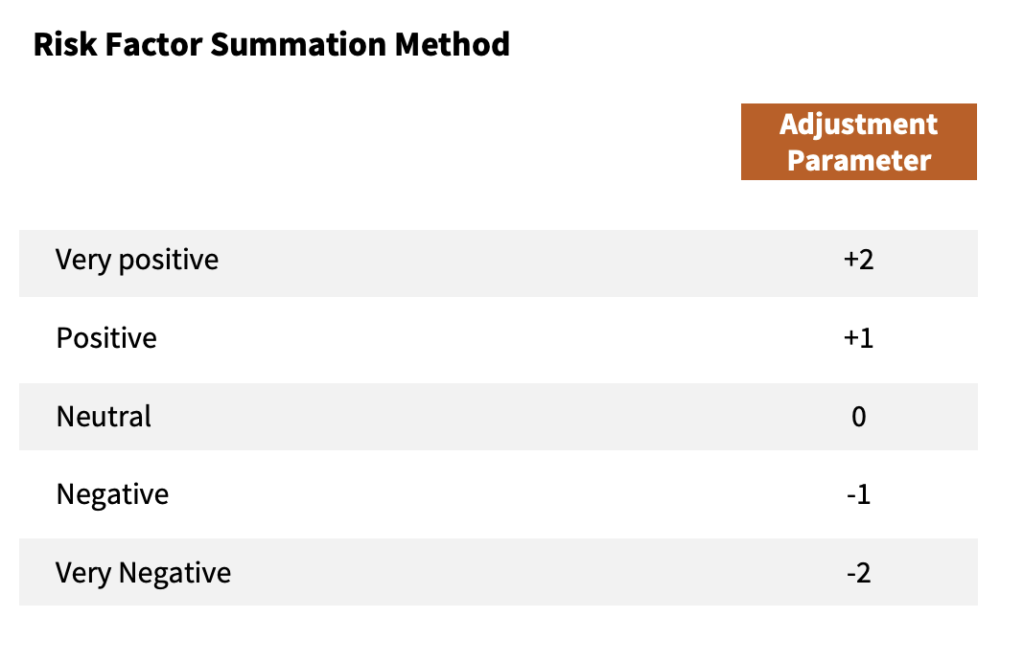

The Risk Factor Summation Method uses the values of similar startups for the company’s valuation. This base value is then adjusted to suit the startup being valued based on 12 risk factors:

- Management: This includes the founders’ background, track record of previous exits, technical knowledge.

- Stage of the business: This refers to how mature your business is. It also assesses the traction of the business.

- Legislation/Political risk: This refers to the government’s policies, laws and regulations that apply to your business.

- Manufacturing risk: This refers to the risk of organizing the supply chain, and the risk of supplier dependencies. This also takes into the account how well you manage your supply chain.

- Sales and marketing risk: In today’s competitive startup environment, marketing your product is the key to success.

- Funding/capital raising risk: Many startups require the founders to raise capital to keep the startup afloat. Some of them (especially sectors like e-commerce) are capital intensive. This risk has two components – the need for ongoing capital, and the probability of a successful capital raise.

- International Risk: Startups with international presence bring a host of new risks associated with them. These include compliance risks, forex risks, political risks and so on.

- Reputation Risk: Reputation refers to the image that you have built up in the industry – what your business is known for. Reputation is greatly influenced by how you treat your customers, vendors, investors, and other stakeholders.

- Exit Value Risk – Exit value risk refers to risk associated with the exit price of your startup. Exit can often happen by way of a strategic acquisition, IPO, or an M&A. The volatility of the exit value is often considered as the ‘exit value risk’

For arriving at the valuation under the risk valuation summation method, each of the above risks are assessed as follows:

The average pre-money valuation of the similar startups is then adjusted positively or negatively based on the above scoring.

Our Take on the Risk Factor Summation Method

- Identifying competitor benchmark data could be an uphill task if a founder were to do it by himself/herself. Moreover, identifying competition with the exact size, nature, and geography could become a challenge. This is because no two startups are alike.

[monsterinsights_popular_posts_inline]

Common Pitfalls in Startup Valuation

- Too Early: We’ve seen a lot of founders making the mistake of doing an equity round too early, either from friends or close family. Let’s say you own a startup, and your uncle has promised to give you $25,000 in exchange for 25% stake in the startup. This implies a post-money valuation of $100,000. If a startup requires additional round of funding, then it makes it difficult for startup founders to explain why someone on the cap table owns 25% for $25K. In such cases, raising capital in the form of loans, or convertible debt may be a better option.

- Too High:It is quite common for startup founders to be excited about their idea. For example, valuing your startup at $5 million with no paying customers, no product falls into the “too high” category. Such high valuation in early stages is usually a put-off to investors when you plan to raise a subsequent round.

- Valuing Your Idea: At KayOne Consulting, we’ve often been approached by enthusiastic founders to value an “idea”. In any start-up the management team (i.e. the ability to execute the idea), the traction (i.e. milestones achieved) are at the core of the valuation exercise. Therefore, valuing an idea is often an illusion rather than a reality. Think twice before pitching an idea to any investor, because you may end up at the receiving end of the investor’s wrath.

- Not Getting the Math Right: Often we’ve seen founders say something like, “We’re raising $200K for a 5% stake”. When they are faced with the question of what it implies from a valuation perspective, they are often stumped. So it’s always good to get your math right before getting into the game of valuation.

What are the Drivers of Valuation

There are a number of factors that influence the valuation of a start-up. Some of them are:

Founding Team:

- How experienced is the founding team?

- Do they have all (or at least most) of the skills to pull of an idea?

- Do they have any prior startup experience? Have they co-founded and/or successfully exited any startup previously?

- Do they have skin in the game?

- Are they full-time into the start-up?

Market Size

- Is the market size big enough?

- How is the market expected to grow within the next 3-5 years?

- What is the addressable market size?

Product

- At what stage is the product in? (i.e. in terms of development)

- Is there any validation on the product-to-market fit?

- Does the product offer a significant advantage to its customers

- Is the product a “pain-killer” or a “vitamin”

- Does the product/technology have any patentability?

Traction

- How many paying customers does the startup have?

- How much revenue has the startup made till date?

- How strong is the sales pipeline?

Financial

- What are the profitability and cash flow projections?

- How high is the burn rate, and what is the available runway?

- How much money has already been invested?

Concluding Thoughts

Valuing startup companies with no revenue is an art and a science. It requires deep understanding of the startup ecosystem, venture capital/angel investing and many other things. If you want to get your startup valued, you should consult a business valuation expert.