iSAFE Notes: The ‘New Normal’ of Start-up Fundraising

Raising Capital for a Start-up

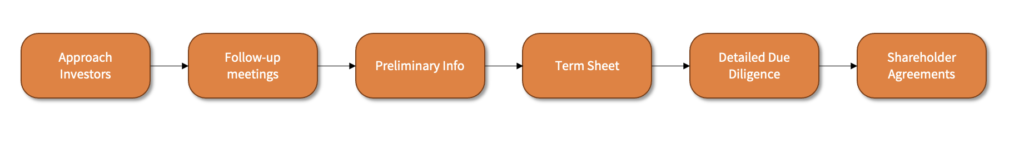

Running out of cash is the most common reason why start-ups fail. Therefore, raising capital is always top on the agenda for any start-up co-founder, especially in its early stages. A typical start-up funding process looks like this:

Shareholder agreements usually take weeks to execute. This involves engaging lawyers, sharing multiple drafts and so on. Not only does it come at a high cost, but it also consumes a lot of time, which is very crucial, especially in the early stages of a start-up.

Enter the word of iSAFE notes – a simple 5-pager that simplifies the documentation procedure for the start-up. Not only does it save a ton of money on legal costs, but it also saves valuable time of the founders and investors, ensuring fasting closure of the deal.

What are iSAFE Notes?

iSAFE stands for India Simple Agreement For Future Equity. 100X.VC, an early-stage investment firm in India was the first to introduce the iSAFE in India. It is an agreement to purchase equity shares of the company at a future date.

To understand an iSAFE fully, we need to understand the difference between a priced round and an unpriced round.

At the early, pre-revenue stage (and sometimes later), most start-up entrepreneurs raise capital in an unpriced round. In an unpriced round the company no valuation is given to the company. Instead, the investor and the start-up agree to issue shares in the future at a valuation that is pegged to a future round.

In a priced round, however, the valuation of the start-up is agreed upfront. The company and the investors know the exact number of shares being issued in exchange for the investment.

iSAFE is commonly used in early stages where the valuation of the start-up is not agreed (unpriced round). In an iSAFE scenario, the investor puts in money, subject to certain valuation conditions (discussed later in this article), in exchange for equity shares that will be issued at a future date. The conversion usually happens when there is a liquidity event (i.e., winding up of the company, or IPO), or a priced round, or the end of three years from the date of issue of the note.

What is the Legal Structure of iSAFE Notes?

Many start-ups issue iSAFE notes because, unlike convertible notes, they are not debt and therefore do not accrue interest. However, for compliance purposes, it is common for iSAFE notes to carry a non-cumulative dividend @ 0.0001%.

Also, since there is no specific law for convertibles like iSAFE in India, they take the form of a Compulsorily Convertible Preference Shares (CCPS). This is governed by Section 42, 55, and 62 of the Companies Act, 2013, read along with the Companies (Prospectus and Allotment of Securities) Rules, 2014 and Companies (Share Capital and Debentures) Rules, 2014.

Since only companies can issue shares, it is a pre-requisite that the start-up should be incorporated as a company under the Companies Act, 2013 to issue a iSAFE. Therefore, a partnership firm or an LLP cannot issue iSAFE notes.

Types of iSAFE Notes

There are five methods to issue iSAFE notes in India:

1. Fixed Conversion:

The company issues fixed number of equity shares at a fixed conversion price on a fixed conversion date.

2. Valuation Cap:

Before we get into the valuation cap, we need to understand the relationship between the valuation and the number of shares issued. In case of a lower valuation, the investors will get more shares, and as a result the founders will dilute more. In case of a higher valuation, the investors will get lesser shares, and as a result the founder dilution will be lesser.

Therefore, investors are usually inclined to pull-down the valuation. On the contrary, the founders are usually inclined to push-up the valuation. The same logic applies to the valuation cap.

In the context of finance, a “cap” usually means “maximum”. The maximum valuation at which iSAFE notes are converted is called a “cap”.

There are two scenarios that are likely when a future priced round happens:

Scenario #1: The future priced round is less than the valuation cap

- iSAFE investment amount – Rs.1 Cr

- Valuation Cap in iSAFE – Rs.10 Cr

- Priced Round (Actual Valuation) – Rs. 5 Cr

- Conversion Rate – iSAFE investors will get 20% of equity in the Company (i.e. 1 Cr ¸ Rs. 5 Cr)

Scenario #2: The future priced round is higher than the valuation cap

- iSAFE investment amount – Rs.1 Cr

- Valuation Cap in iSAFE – Rs.10 Cr

- Priced Round (Actual Valuation) – Rs. 15 Cr

- Conversion Rate – iSAFE investors will get 10% of equity in the Company (i.e. 1 Cr ¸ Rs. 10 Cr)

In Scenario #1 the iSAFE investors get a higher stake to compensate for the lower valuation.

3. Discount

A discount scenario happens when there is no valuation cap. This is the most favorable scenario for the founders. The conversion of the iSAFE notes happens at a discount (usually 15%-30%) to the next priced round.

Let’s look at an example.

- iSAFE investment amount – Rs.1 Cr

- Discount on the next priced round – 20%

- Priced Round (Actual Valuation) – Rs. 15 Cr

- Valuation for the purpose of conversion – Rs.12 Cr (i.e., 20% discount on Rs.15 Cr)

- Conversion Rate – iSAFE investors will get 8.33% of equity in the Company (i.e. 1 Cr ¸ Rs. 12 Cr)

4. Valuation cap with discount

In this scenario, both a valuation cap and a discount exist.

Let’s look at an example.

- SAFE Note investment amount – Rs.1 Cr

- Discount on the next priced round – 20%

- Valuation Cap – Rs.10 Cr.

- Priced Round (Actual Valuation) – Rs. 15 Cr

- Valuation for the purpose of conversion – Rs.10 Cr (i.e., lower of Rs.10 Cr or 20% discount on Rs.15 Cr = Rs.12Cr)

- Conversion Rate – iSAFE investors will get 10% of equity in the Company (i.e. 1 Cr ¸ Rs. 10 Cr)

5. Most Favored Note (MFN)

It is usually quite common for early-stage start-ups to raise multiple iSAFE notes or unpriced rounds by issuing iSAFE notes or CCPS. The Most Favored Note clause in an iSAFE note requires the company to issue any favorable terms issued to the subsequent investors, to the iSAFE note holders as well. The aim is to ensure that all investors are treated at par.

How is iSAFE Notes Different from Convertible Notes?

A convertible note is essentially a debt that carries interest. A debt can usually be secured (by way of hypothecation of intellectual property, receivables and so on) or unsecured. However, an iSAFE is not a debt, and does not accrue interest. If the start-up fails, then whatever money is left in the company will be returned to the iSAFE holders first, before paying off the equity shareholders.

How is iSAFE Notes Different from CCPS?

Under the Companies Act, 2013 an iSAFE note is treated on par with a CCPS. However, the CCPS holders get an advantage over iSAFE holders in the following areas:

- CCPS holders usually get a right to exit in an SHA. However, iSAFE can only convert to equity unless there is a liquidation event

- CCPS holders may get a board seat. It is not common for iSAFE holders to have a board seat in the start-up

- A third-party valuation is usually required when CCPS is issued. Issuing iSAFE does not require a third-party valuation.

How is iSAFE Different from a Share Holder Agreement (SHA)

The whole point of issuing an iSAFE is to do away with the detailed SHA. Therefore, only one of them can be executed at the same time. When a priced round happens, a detailed SHA is imperative. At that point in time, the iSAFE will be terminated and the final terms are governed by the SHA.

Benefits to Investors

An iSAFE offers several benefits to investors:

- There is no dilution in the cap table till the priced round (or an early conversion) happens.

- Time to close the deal is shortened at least by a few weeks. This is due to the time saved in documenting an SHA and the multiple iterations associated with it.

- If the start-up fails, the iSAFE note holders still get a preference over the founders and other equity shareholders. They get a higher right to receive whatever money is left in the start-up, helping them recover at least a part of their investment.

Benefits to Start-ups

The benefit to start-ups is as follows:

- Since an iSAFE is not a debt, there is no interest that accrues on the iSAFE note. At a later stage, if the start-up raises venture debt, the iSAFE note does not impact the debt-equity ratio.

- An iSAFE note is a simple five-page document. The start-up will save significant money in engaging lawyers to draft detailed SHAs.

Valuation Requirements

The whole purpose of purpose of issuing iSAFE notes in Indiais to do away with the valuation requirements. Most early-stage start-ups are at the idea, MVP, or pre-revenue stage. Assigning a value to such start-ups is difficult for the valuer, and unfair to the start-up.

Issuing iSAFE notes does away with the valuation exercise, since the valuation is essentially postponed to a later date (i.e., when the priced round happens). This makes the life of the founders and investors happy.

Secretarial Requirements

As discussed earlier, iSAFE notes in India take the form of CCPS. Hence the company needs to have adequate authorized share capital to issue such preference shares.

The key steps in issuing iSAFE notes are:

- Step 1: Increase authorized share capital of the company by passing board resolution for convening an EGM and proposing to issue iSAFE notes. The company should also pass the necessary resolutions in EGM to authorize the increase of capital. Once this is done, Form MGT-14 should be filed with ROC within 30 days. The company should also file Form SH-7 with the ROC within 30 days.

- Step 2: Enter into an iSAFE agreement. The agreement should clearly specify the valuation cap, discount, investment amount, liquidation preferenceand other terminology.

- Step 3: Issue the iSAFE by way of private placement or rights issue (as the case may be). It is common to issue the iSAFE notes by way of rights issue to skip the valuation requirements under the Companies Act, 2013 (Ironically iSAFEs by their design don’t require valuation – but our Companies Act doesn’t explicitly recognize it).

- Step 4: On receipt of the money, convene the necessary meetings to allot the iSAFE notes as CCPS. File Form PAS-3 as if the securities being issued are preference shares.

Accounting and Reporting Requirements

There is no specific guidance issued by the accounting standards or the Institute of Chartered Accountants of India for accounting iSAFE notes in India. However, since the iSAFE notes in India take the legal form of CCPS, they have to be shown under the Preference Share Capital head. These will be ultimately classified under the “Shareholder Funds” head of the balance sheet.

Tax Requirements

Since iSAFE is a relatively new concept in India, there is no specific guidance on taxation of iSAFE Notes in India. However, since iSAFE notes are treated as CCPS, we look at Section 47(xb) of the Income Tax, 1961. According to this section, any transfer by way of conversion of preference shares of a company to equity is not regarded as transfer. Accordingly, there is no tax at the time of conversion of iSAFE notes to equity.

At the time of sale of the converted equity shares, the transaction would attract capital gains. The capital gains are payable on the difference between the price at which the shares are sold and the price at which the iSAFE notes converted to equity. Depending on the holding period, the tax could either be short-term capital gain, or long-term capital gain.

Conclusion

In this article we have seen what iSAFE notes are and the various ramifications of its issue, accounting, taxation, and compliance aspects. While iSAFE notes in India are relatively a new concept, increasingly start-ups are using iSAFE notes because it saves a lot of time and costs to the start-up.

However, it is easy for founders to get carried away on the simplicity of the document. Since iSAFE will ultimately end up in a dilution on the cap table (at the time of conversion), start-up founders need to engage experts like Virtual CFOs to negotiate specific clauses like valuation cap, liquidation preference and so on.