Phantom Stock in India: Everything You Need to Know

What is Phantom Stock?

Phantom Stock (also known as shadow stock) is increasingly becoming a new way of compensating and retaining key employees. Thanks to the recent start-up boom, India is now home to more than 100+ unicorns.

In simple terms phantom stocks are like ‘mock-stocks’. Employees do not own the stock but get the full benefits of ownership like increase in stock price, dividends and so on. So effectively, phantom stocks do not dilute ownership of founders or investors on a cap table. However, companies issue phantom stock to compensate employees and use it as a share-based payment to retain key talent.

Recent studies show that the Great Resignation is nowhere close to slowing down. 40% of employees are expected to quit their jobs in the next 12 months. In times like these, it becomes critical to retain senior and key employees, by offering attractive pay packages. These packages often include share-based payments such as ESOPs and Phantom Stock.

[monsterinsights_popular_posts_inline]

How Does It Work?

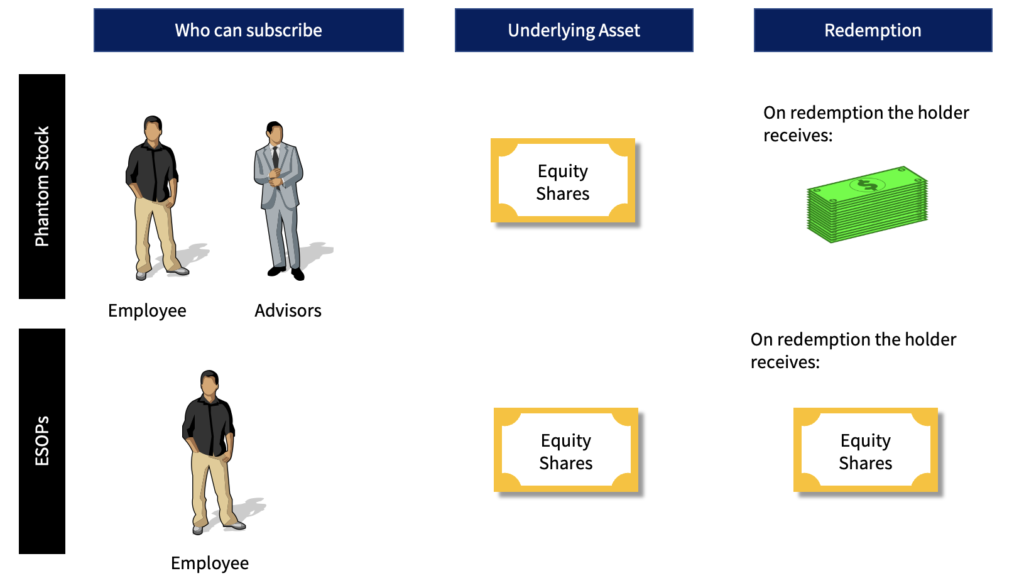

Phantom share is essentially an agreement between the company and the subscriber (usually an employee or an advisor) to receive cash at a future point in time. This cash payment is directly linked to the market value of the underlying company stock.

At first glance, phantom shares look very similar to employee stock options. The key difference is that under an employee stock option, the employee will end up owning shares in the company, subject to certain conditions. Whereas under the phantom share plan, the employee does not own the stock, but will get to enjoy the benefits of ownership such as increase in stock price, dividends and so on.

Common Types

There are two ways in which phantom stocks are used for employee compensation:

- Appreciation Only: Under this type of plan, the employee receives the difference in stock price between the date of issue and the date of redemption. For example, if an employee is issued phantom shares in Jan 2022, when the price per share is Rs.100. He redeems the stocks when all the conditions are met in September 2022, when the price per share is Rs.180. In this case, the employee receives Rs.80 (i.e., the difference between Rs.180 and Rs.100) as a cash payment from the company.

- Full Value: Under this type of stock plan, on the date of redemption, the employee would receive the full value of the underlying stock. For example, if an employee is issued phantom stocks in Jan 2022, when the underlying share price is Rs.100. He redeems the stocks when all the conditions are met in September 2022, when the price per share is Rs.180. In this case, the employee will receive the full value of the stock price – Rs.180 as a cash payment from the company.

[monsterinsights_popular_posts_inline]

Example:

ABC Limited issues 100 phantom stock units to Mr. K on 1st January 2022. The price as on the date of issue is Rs.1200. The units vests after six months, subject to Mr. K bringing in new revenues of Rs.10 crores. The price on 30th June 2022 is Rs.1850 per share. Mr. K redeems his phantom stock units on 30th June 2022.

Now assuming Mr. K fulfils the revenue criteria, the following table shows the pay-out on 30th June 2022:

| Appreciation Only | Full Value | |

| Stock price as on 30th June 2022 | Rs. 1,850 | Rs. 1,850 |

| Stock price as on 1st January 2022 | Rs. 1,200 | Rs. 1,200 |

| Appreciation | Rs. 650 | Rs. 650 |

| Pay out per stock unit | Rs. 650 | Rs. 1,850 |

| Number of phantom stock units | 100 | 100 |

| Total payout on 30th June 2022 | Rs. 65,000 | Rs. 185,000 |

Trigger Events

Just like ESOPs, there are several trigger events in a phantom stock:

- Issue: When an employee is issued phantom stocks, the date on which such issue happens is called the issue date.

- Vesting: Vesting is the right to exercise/redeem the phantom stock. This is usually dependent on certain conditions, or certain timelines. These are called vesting schedules. Examples of conditions of vesting include:

- The company achieving Rs.100 crores of revenue or another financial milestone

- The company launching a certain product

- The employee closing Rs. 10 crores of sales

- Exercise/Redemption: This is the date on which the employee chooses to redeem the phantom stock in exchange for cash. Depending on the type of the option, he/she may either get the full value of the underlying stock or the differential appreciation.

Tax Implications

When it comes to income taxes, there are three events that we need to consider:

- When phantom stock is issued: When phantom stock is issued, the employee only receives the right to get a certain payment at a future date, subject to certain conditions. Therefore, there is no taxation trigger on the issue date.

- When conditions are fulfilled: When the underlying conditions are fulfilled, the employee only re-affirms the right to get a certain payment at a future date, subject to certain conditions. Therefore, there is no taxation trigger on the vesting date.

- When phantom stock is redeemed: When the underlying phantom stock is redeemed the amount of cash that the employee receives (both under the appreciation only plan, and the full value plan) is taxed in the hands of the employee as perquisites, under the head income from salaries.

There is no specific tax obligation on the company (employer), other than deducting TDS at the applicable rates since the payment is taxed under the head of income from salaries.

[monsterinsights_popular_posts_inline]

Legal Framework

The legal framework in India regarding phantom stocks is very vague, and generally silent. The concept of phantom stock is still new to India, and the legislature is yet to announce formal rules, laws, and regulations for phantom stocks.

Companies Act 2013

The Companies Act 2013 is broadly silent about phantom stocks. The Act has prescribed rules and regulations for issue of stock options but does not specify anything about phantom stocks including Stock Appreciation Rights (SARs).

SEBI Regulations

SEBI regulations generally apply to listed companies in India. So, these regulations do not have a direct bearing on unlisted companies, and start-ups. The SEBI regulations read with the Companies Act prescribe rules and regulations for issue of employee stock options, and equity settled SARs for listed companies.

Informal Guidance given by SEBI

In 2015, Mindtree Limited approached SEBI for an informal guidance with reference to SARs and Phantom Stock. SEBI clarified that the SEBI regulations should be applied to an employee benefit scheme when such scheme should involves “dealing in, or subscribing to, or purchasing, securities of the company directly or indirectly”.

Since Mindtree’s phantom stock plan did not involve a purchase or subscription of shares by eligible employees at the time of the exercise of the right but was in the form of cash payments for appreciation in the share prices, the SEBI regulations do not apply. However, we need to understand that this was an “informal guidance” for a specific situation. Hence this guidance cannot be applied generally.

Accounting Considerations

The Guidance Note on Accounting for Share-based Payments (Revised 2020) issued by the Institute of Chartered Accountants of India is silent on phantom stocks. However, the guidance note has given clear guidance on accounting for SARs. The guidance note requires that the value of the SARs be expensed in the income statement based on the expectations of the vesting schedules.

[monsterinsights_popular_posts_inline]

Pros and Cons of Phantom Stocks

Pros

- Phantom stocks can be issued by both public and private limited companies. There is very little regulation (except for listed companies) for issue of such stocks to its employees.

- As on the date of issue, and during the vesting period, there is no tax levied on the employee.

- Even though the employee does not have voting rights, the employee stays invested in the company’s growth

- Since these plans involve a cash outflow, it will have no impact on the cap table.

- Phantom stocks involve cash-based payments. Since the employees don’t end up owning stock, there is no threat of the employee selling the vested stock to the competitors.

Cons

- From an employee point of view, an ‘appreciation-only’ option is attractive only if the company does well (and the share price increases as a result)

- Employers need to have cash in hand to settle the employees when the redeem the option. For many start-ups that are cash strapped, this could become a potential issue in the long run.

- There could be costs of third-party valuation if the company is unlisted.

Key Ingredients of a Successful Phantom Stock Plan

The following are the key ingredients of a successful phantom stock plan:

- Decide on the vesting conditions of the stock plan: The vesting conditions of the phantom stock plan should be clearly laid out. These vesting conditions could be time-based or milestone-based or a combination of the two. Eventually the phantom stock plan should align with your company’s culture, vision, and its long-term goals. You also need to decide whether you are going to issue “appreciation only” or “full value” stocks.

- Establish a proper valuation methodology: One of the common mistakes in a phantom stock plan is not defining the valuation methodology. Due the subjective nature of the valuation exercise, it is quite common that different valuers assign different values to a company. This problem is more predominant in unlisted companies. The best way to overcome this is to have an upfront valuation methodology defined in the plan – this is usually a revenue multiple, or an EBITDA multiple.

- Decide how to allocate the stock: Many companies end up issuing stock in the very early stages. Usually, they run out of the option pool even before the full executive team is in place. Another issue is on the quantum and methodology. If your company is paying salaries that are lesser than market value, it is best to compensate the employees by allocating sufficient stock options.

[monsterinsights_popular_posts_inline]

Pre-requisites for Successful Implementation of a Phantom Stock Plan

Companies should address the following when formulating a phantom stock plan

- Are my company’s short-term and long-term goals clearly defined?

- What behavior or performance metrics is the company planning to incentivise?

- Who will be allowed to participate?

- How many stock units (number of shares) should I dedicate for this plan?

- Should the plan be “appreciation only” or “full value”

- How frequently will the stock units be granted (i.e., upfront, or quarterly or annually?)

- Vesting conditions – are they time based on milestone based (or both?)

- Forfeiture conditions – minimum performance, termination/exit

- What will be the funding mechanism to fund the pay-outs? What are the probabilities and expected timelines of these payouts?

- What are the valuation methodologies for determining the value of the stock – applicable for unlisted companies

Frequently Asked Questions

- How do you determine the value of the phantom stock units? The phantom stock prices are equal the value of the shares of the company. The valuation methodology for unlisted companies is usually pre-determined.

- How much tax should I pay for receiving phantom stock units? Phantom stocks are not taxed when they are issued. They are taxes when they are exercised and converted to cash. The taxation is under the head – income from salaries. It is taxed as a perquisite depending on your income slab.

- Are phantom stocks eligible for dividends? Phantom stocks can, but usually don’t pay dividends. It finally depends on the phantom stock option plan that the company creates before issuing these stocks.

- How are phantom stocks different from ESOPs? Under ESOPs, employees actually receive shares. Under a phantom stock plan, employees only receive the benefit of owning the stock, but not the actual stock itself.

- How is a phantom stock different from a profit-sharing plan? Under a profit-sharing plan, the employee only receives a share of the profit that the company makes. He/she does not receive any compensation for appreciation of the stock price. Under a phantom stock plan, the employee receives cash directly linked the stock price.

[monsterinsights_popular_posts_inline]

Conclusion

The concept of Phantom Stocks is increasingly becoming popular in India. It has become more relevant especially in this post-pandemic world where uncertainty taken precedence and retaining key employees has become an uphill task for employers. Considering the clear use-cases of phantom stocks, the advantages that they bring to the table will most certainly make them a popular tool for incentivising and retaining employees.