SaaS Burn Multiple: The ‘New Normal’ of Evaluating Startups

Fears of recession started setting in post the Ukraine-Russia war in 2022. Capital has increasingly become difficult to raise for many startups. Both large corporates as well as start-ups have been on a firing spree since mid-2022. Investors have started monitoring the capital efficiency (i.e., how efficiently is the capital used) closely. The SaaS burn multiple is one such capital efficiency metric that startup founders, and investors are closely reviewing before, during and after a capital raise.

In this article, we are going to look at what burn multiple is for SaaS companies, how to calculate burn multiple, and what early-stage startups can do to keep the burn multiple in check.

The Growth vs Burn Dilemma

Growth is always good for startups – both during good times and bad times. However, start-ups which burn high amounts of cash usually find it difficult to raise cash in bad times. There is always a trade-off between growth and burn.

The growth vs burn dilemma is more visible in the tech sector. On one hand, startups need to grow by investing capital in building a team, building a product-to-market fit, and gain initial traction or a competitive market advantage. On the other hand, startups must be careful not to overspend their cash and available resources without a clear path to profitability.

This is a typical catch-22 situation where startup founders are at logger heads with contradictory objectives. Such situations are especially challenging for startups that are in the pre-revenue or early-revenue stage because they do not have clear predictability of revenues.

This is why monitoring the SaaS Burn multiple becomes critical. Most of the startup founders know their annual growth like the back of their hands. However, not many founders know, or measure the SaaS burn multiple.

[monsterinsights_popular_posts_inline]

SaaS Burn Multiple Formula

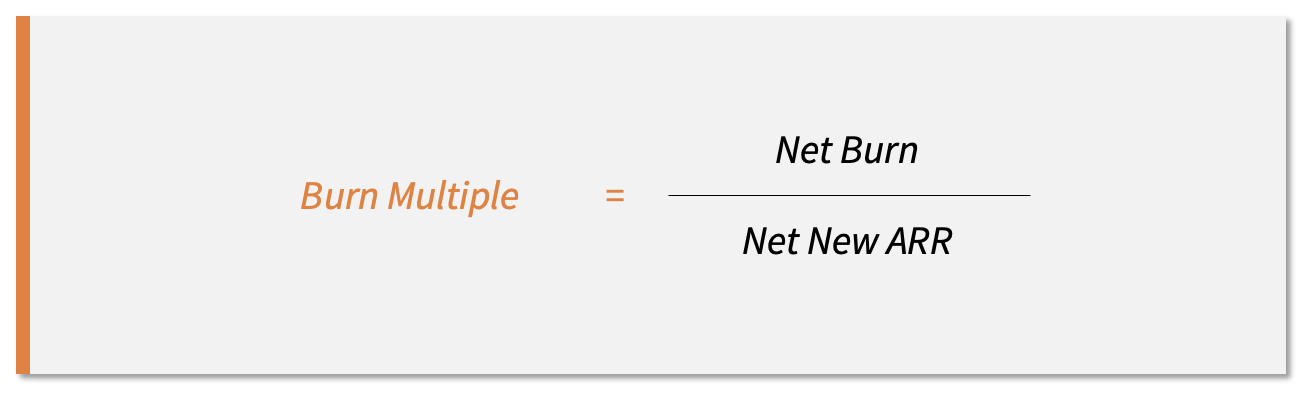

The SaaS burn multiple was popularized by David Sacks, the co-founder of Craft Ventures. It defines the amount that the startup is burning for generating one dollar of incremental annual recurring revenue (ARR).

The burn multiple calculation has the following definitions:

Net Burn = Cash Revenue – Cash Operating Expenses

Net New ARR = New ARR + Expansion ARR – Churned ARR

SaaS startups generate revenues from subscription services and/or multi-year contracts. This makes the burn multiple a highly relevant metric for high-growth SaaS startups. The usefulness of the burn multiple stems from its ability to assess the cost at which growth is generated, rather than focusing solely on the rate of growth itself.

Burn multiple can be expressed on a monthly, quarterly or an annual basis. This involves computing the net burn by considering the respective revenue and expenses.

For example, if a startup has a burn multiple of 1.0x, it means that the startup generates one dollar in net new ARR for every dollar spent. On the other hand, if the burn multiple is 2.0x, it only produces a half in net new ARR for every dollar spent by the startup in cash terms.

[monsterinsights_popular_posts_inline]

Burn Multiple Benchmarks: What is the ‘Sweet Spot’

Most startups burn cash. Burning cash to acquire market share is inevitable for high-growth startups. But where do you draw the line? Is there some benchmark available?

Fortunately, in the venture capital world, there are some rules of thumb that are used to benchmark the SaaS burn multiple:

If a startup is burning $3 million during a quarter, to generate $1.25 million of net new ARR, then the burn multiple is 2.4x. That is normal for early-stage startups, but it puts the startup under the “suspect” category. If the start-up continues to burn cash at this rate, it could have dire consequences in the long-term. It should cut costs immediately. On the other hand, if the start-up burnt $3 million during a quarter, and generated $2 million in net new ARR, then the burn multiple is 1.5x.

Many start-up founders focus exclusively on growth, without focusing much on burn. If the start-up requires high rates of investments to deliver growth, then there is something fundamentally wrong with the business model. Higher the burn multiple, higher is the probability of running into financial troubles in the long-term.

[monsterinsights_popular_posts_inline]

Where Does the Problem Lie?

The SaaS burn multiple gives a holistic view of the start-up’s performance. The burn multiple can be skewed with an issue in any of the following:

Gross Margin

In many cases, the burn multiple calculation is often “out of range” because of a simple, yet fundamental issue in the business model. A high burn multiple can be driven by low gross margins. Typically, gross margins range between 70-85% for most startups.

Source: Software Equity Group

High Churn

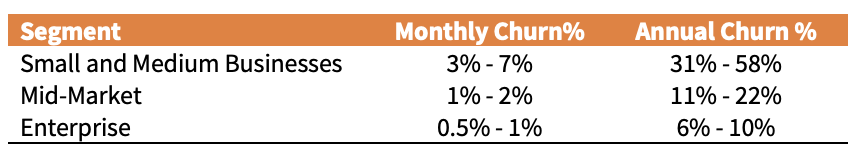

A high churn rate is a significant problem for any business. Churn is defined as the rate at which customers or subscribers stop using a product or service during a given period. When the churn is high, it means that the start-up is unable to retain its customers. This could have a detrimental effect on revenue and growth in the medium and long-term.

Here are some SaaS churn benchmarks:

Source: Red Point

A high churn can be a result of bad customer experience (either in the product, or with the CX team), inadequate product-market fit, lack of product differentiation, or high pricing. When a start-up has a high churn, then it must continuously invest in sales and marketing expenses, to get new customers. Unless you fix the underlying reasons for a high churn, such as fixing your customer experience team, product bugs or pricing issues, the churn will never come under control.

[monsterinsights_popular_posts_inline]

Sales Efficiency

Sales efficiency is an important metric for startups as it directly affects revenue growth as well as profitability. It measures how effectively a company’s sales team can convert the investment into sales and marketing into revenue. If a company burns cash in sales and marketing, and such investments don’t convert to revenues, then it has low efficiency scores in sales and marketing. Lower sales efficiency can be a result of lack of well-defined processes, wasted/inefficient resources, and a longer sales cycle.

Lower sales efficiency can also be a result of a misalignment between marketing and sales efforts. One way to identify this issue issue is looking at the percentage of sales-qualified leads (SQL) as a percentage of total leads. If the sales team continuously gets poor leads, then it is often a marketing issue, and not a sales issue. Failure to align these efforts can lead to ineffective lead generation, disjointed messaging resulting in a lower sales efficiency.

Growth Challenge

Startups face several challenges when it comes to achieving sustainable growth. The growth challenge comprises of two parts – internal issues and external issues. Internal issues go together with the sales efficiency and is often a fall out of poor sales and marketing efficiency. External issues can be because of poor product-to-market fit, lack of differentiation, saturating market and macro-economic conditions.

Collections

Collection issues arise when your start-up is not able to collect invoices. This is more relevant in B2B start-ups, than B2C. In B2C start-ups it is common to collect invoices upfront, and therefore collection issues don’t arise. When start-ups have a collection issue, the cash burn becomes high. This is because, the start-up continues to pay for expenses, and costs, while the inflow of cash is low because of poor collections.

[monsterinsights_popular_posts_inline]

What is a Good Burn Multiple?

The general notion is that the start-up’s burn multiple should improve as the start-up matures. A seed stage company’s Burn Multiple may be around 3x because of high investments in customer acquisition and finding a product-to-market fit.

At the Series A stage, the multiple usually drops to around 2x, and after Series B, when the sales efficiencies are expected to kick in, the SaaS burn multiple should even reduce further. In today’s economic situation, the road to profitability has become important. These days, investors focus on profitability as much as growth. If the start-up turns profitable, then it stops burning cash. Therefore, the burn multiple will approach zero by the time the start-up turns profitable.

[monsterinsights_popular_posts_inline]

What Can Founders Do?

SaaS Burn Multiple offers a comprehensive view of the startup’s expense patterns. There are several things founders can do to keep this metric under control:

Firstly, the priority is to keep the expenses and salaries under control. Hire only when it is a ‘must-have’ and not a ‘nice-to-have’. By hiring and spending when essential, it extends the runway and keeps the burn rate under control. This will also be an attractive proposition to investors when the start-up presents itself for a capital raise.

Secondly, the founders should focus on gross margins. This is often an over-looked metric where most founders assume that nothing much can be done. Even small savings (in percentage terms) can bring a significant burn reduction (in dollar terms), keeping the burn under control.

Lastly, the founders should focus on higher sales efficiency. This can be achieved by streamlining the sales process, reducing the sales cycle, bringing repeatability by way of training, and aligning the marketing function to sales.