Tax Benefits for Startups in India: A Primer

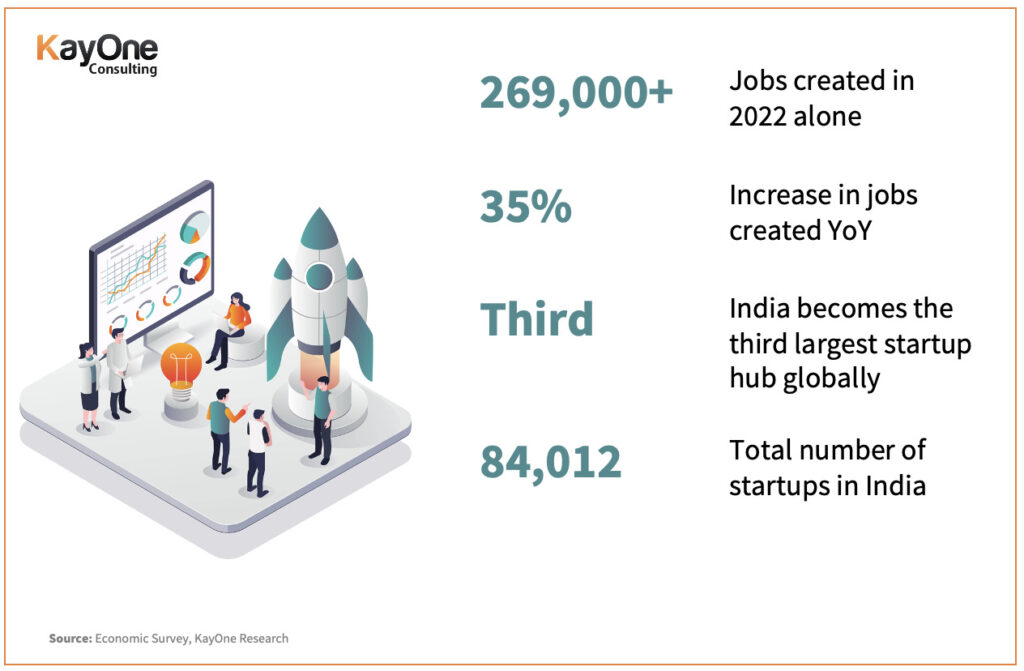

The startup ecosystem in India has rapidly grown in recent years and has become one of the fastest-growing startup scenes in the world. To woo more investors and entrepreneurs, the tax benefits for startups in India have also gained a significant momentum over the last few years. With a large and young population, a growing middle class, and increasing access to capital and technology, the country has become an attractive market for entrepreneurs and investors.

The Indian government has also taken steps to support the growth of the startup ecosystem, including launching initiatives like Startup India and Digital India, which aim to provide a supportive environment for startups through funding, mentorship, and regulatory support.

Growth of Indian Startups

Additionally, there has been an increase in the number of accelerators, incubators, and co-working spaces in India, providing resources and support to entrepreneurs at the early stages of their businesses. The growth of e-commerce and digital payments has also created a thriving market for tech startups.

The growth of various industries such as fintech, health tech, agtech, edtech, and e-commerce also drives the startup ecosystem in India. These industries attract significant investment and have produced some of the country’s most successful startups. The Indian fintech sector, for example, has snowballed in recent years and is now worth billions of dollars.

Another factor contributing to the growth of the startup ecosystem in India is the increasing number of successful exits, such as mergers, acquisitions, and initial public offerings (IPOs). This has not only provided returns for investors but has also created a culture of entrepreneurship and encouraged more people to start their businesses.

There has also been an increase in venture capital firms and angel investors investing in Indian startups, providing crucial funding for early-stage businesses. Additionally, large corporations in India are becoming more involved in the startup ecosystem through investments, partnerships or by setting up their innovation labs.

[monsterinsights_popular_posts_inline]

Tax Benefits for Startups in India – Recent Changes

The last seven years have seen a radical shift in the business ecosystem under the leadership of Prime Minister Modi. Starting in 2016, the government announced several tax benefits for startups in India designed to promote rapid growth. Entrepreneurs and startup owners are gaining recognition as the key drivers that can boost the economy.

In addition to regulations to streamline the incorporation process, the government has enabled bank loans and other sources of finance. Startup India is just one of the several programs instituted to nurture upcoming ventures. The objective is to transform India into the world’s leading startup hub. Read ahead for more details about the tax exemptions you can avail of as an entrepreneur.

Who Can Avail of the Tax Benefits for Startups in India?

That’s likely your first question. The government has defined eligible startups as companies filing for incorporation between April 1, 2016, and March 31, 2023. The latest budget for the fiscal year 2023-24 has extended tax incentives to March 31, 2024. As finance minister Nirmala Sitharaman announced, “I propose to extend the date of incorporation for income tax benefits to startups from March 31, 2023, to March 31, 2024. I further propose to provide the benefit of carrying forward losses on change of shareholding of startups from seven years of incorporation to ten years.”

[monsterinsights_popular_posts_inline]

Eligibility Criteria

For eligibility for the Startup India Action Plan, your new venture must fulfil these criteria:

- Your startup is less than ten years old from the date of incorporation or registration.

- Your startup is a private limited company, partnership firm, or limited liability partnership.

- The company has a turnover of less than INR 100 crores in any financial year.

- The venture works toward innovating new products or services or developing or improving existing outcomes.

- Companies pioneering in their respective spheres qualify for incentives if they have developed innovative technology with GOI funding.

- The company has the potential to generate high employment and wealth with an efficient and scalable business model.

- Your company is not formed by splitting up and reconstructing an existing entity

- Your company has received funding from a business incubator that has, in turn, acquired finance from a GOI and works on a government undertaking.

- The company has acquired certification with a proper SIPP (Startups Intellectual Property Protection)-recommended format.

- The company has received funding from any investors registered with SEBI, including private equity funds, incubation funds, or angel networks.

- Your venture has a patent grant from the respective regional office of the Indian Patent and Trademark.

[monsterinsights_popular_posts_inline]

Tax Benefits For Startups in India

Here are some of the tax benefits for startups in India.

Three-Year Income Tax Rebate – Section 80-1AC

Section 80-1AC allows for a 100% tax exemption on profits for three years in any of the seven consecutive assessment years. The GOI understands that entrepreneurs typically incur substantial financial burdens with startup costs. Not paying taxes for the initial three years could help them offset spending and reach the breakeven point sooner. As a result, the new venture could start yielding high profits sooner. This rebate is subject to certain conditions, such as:

- This benefit is available for any startup incorporated after April 1, 2016, but before April 1, 2021.

- The company’s annual turnover should not exceed INR 25 crore for the financial year it wants to claim the deduction.

- The company must pay the Minimum Alternate Tax [MAT] at 18.5%, in addition to surcharges and cess as applicable. However, if the startup makes no profits, the FM has assured MAT exemptions for the initial five years.

- The startup should be registered with the Department of Industrial Policy and Promotion (DIPP).

- The venture should work in the sphere of Intellectual Property and should be innovation-driven, and its mission should be to develop and produce disruptive products and services.

Capital Gains Tax Exemptions – Section 54EE

The capital gains exemption is one of the most crucial tax benefits for startups in India. Companies raise funding by sharing stock, and any profits from such dealings are capital gains. These long-term capital gains are subject to capital gains tax. However, eligible startups can get a 20% exemption on capital gains by investing their earnings. As a result, they can pay less tax on the profits they earn by selling their assets. These assets may include shares, stocks, and bonds. This rebate is subject to certain conditions, such as:

- The earnings should be invested in the Central Government’s special funds.

- The investment can be up to INR 50 Lakhs.

- The capital gains should be diverted to the special funds within six months from the date of the transfer of the assets.

- Exemptions are valid for three years, meaning the amount should remain invested for this time. If the asset holders withdraw the funds before the 3-year limit, the exemption is no longer valid. The asset will incur capital gains tax in the year when the money is withdrawn.

[monsterinsights_popular_posts_inline]

Angel Investment Tax Exemption

Until May 24, 2018, individual angel investors paid an angel tax on the funds they invested in an unlisted firm, and the tax levy was more than 30% of the share price above fair market value. New regulations have eliminated the angel investment tax, but this waiver is subject to certain conditions.

- Angel investors must meet specific criteria. The startups where they invest must acquire a report from the merchant banker. This report must specify the fair market value of the shares per income tax regulations. The Central Board of Direct Taxes (CBDT) has made this requirement mandatory via Rule 11 UA (2)(b) of the Income Tax Act, 1961.

- Angel investors can get a 100% tax exemption on their investments if they have a minimum net worth of INR 2 crore. Or, they should have an average return income of over INR 25 Lakhs in the preceding three financial years. The 100% tax rebate applies to shares purchased above the fair market value.

- The startup’s paid-up capital and share premium cannot exceed INR 10 crore after the share issue.

- The tax rebate is available to investors funding startups incorporated after April 1, 2016. This rule has received accolades as the ideal tool for levelling the playing field for startup investors, and it is one of the best tax benefits for startups in India.

- Startups incorporated on or before April 2016 can also request exemptions from Section 56 of the Income Tax Act, 1961.

Other than angel investors, this new exemption extends to other sources of funds, including family and friends. In short, investors not registered as venture capital funds can purchase shares above fair market value without incurring taxes.

Individual or HUF Investors Tax Exemption – Section 54GB

Individuals or Hindu Undivided Family (HUF) wishing to sell their properties and invest in startups can get tax exemption. Individual owners or HUFs can invest the gains or proceeds in Micro, Small, and Medium Enterprises on selling a residential property. By doing so, they can avail of the exemption from tax on long-term capital gains. The new regulations now include investments in eligible ventures, making it one of the best benefits for startups in India. Some conditions include:

- If the investors divert their capital gains to subscribing 50% or more equity in an eligible startup, they won’t pay tax.

- As long as they don’t sell or transfer the shares within five years from the date of purchase, they are exempt from paying taxes on long-term capital gains.

- The startups must use the invested amount to purchase assets, and they cannot transfer the assets purchased from this sum within five years from their purchase date.

[monsterinsights_popular_posts_inline]

Presumptive Tax Benefit

Before discussing presumptive tax as one of the tax benefits for startups, one must understand what it is. Under Section 44AD of the Income Tax Act, a business with a turnover of fewer than two crores can choose to pay a presumptive tax. They must declare 8% profits from non-digital transactions and 6% from digital transactions when filing their returns. Eligible startups can take advantage of this waiver and eliminate the pressure to maintain books of accounts and other records.

Concluding Thoughts

The Indian government has instituted several tax reforms to encourage innovation and entrepreneurship in the country. Relief from tax burdens can go a long way in promoting startups and giving that all-needed push to this sector. The tax benefits for startups in India can enable business owners to establish and run self-reliant organizations. Such companies are integral to the vision of Atma Nirbhar Bharat.

If you are looking to take advantage of all the startup benefits, you will need a Virtual CFO. A Virtual CFO is a part-time business expert, who can help streamline your accounting, tax, and finance related issues.

Contact us to learn more about how our team of experts can help your business maximize its savings and take advantage of every available tax credit. Get started today and see the difference a Virtual CFO can make!