VC Term Sheet: 10 Important Clauses That You Should Know

The VC term sheet is the first step where the rubber meets the road. You have spent months building the product, recruiting the team, and finding the right product-market fit. You probably have raised capital from friends and family and gained the early traction VCs usually seek.

What is a VC Term Sheet

A term sheet is a non-binding agreement between the investor and your start-up. This forms the basis for legally binding documents, such as the Share Subscription Agreement (SSA), the Stock Purchase Agreement (SPA) and the Shareholder’s Agreement (SHA). In some countries, term sheets are also called a “letter of intent,” “memorandum of understanding,” or an “in-principle agreement.”

The primary purpose of a term sheet is to lay out the initial conditions of the investment, such as:

- Type of stock

- Capital infused

- Pre-money valuation

- Investor rights and preferences

- Other standard investor protection clauses.

The term sheet outlines the principles for ensuring that the investor and your start-up agree on all significant aspects.

Download the Sample VC Term Sheet

The Objectives of a VC Term Sheet

The main objective of putting a term sheet together is to agree on the significant aspects of the deal. That said, each stakeholder seeks different values from a term sheet.

The Investor Perspective

From the VC’s standpoint, the main objectives are:

- Maximize potential financial returns from the investment

- Minimize risk of downside (e.g., Anti-dilution, liquidation preferences)

- Ensure proper governance and control (e.g., reserved matters that require approval or a board seat)

- Minimum rights (eg, drag along, tag along)

- Clear exit options

Founder Perspective

- Get a fair valuation

- Retain operational and financial control

- Maintain majority stake (at least in the early stages)

- Standards, rights, and preferences

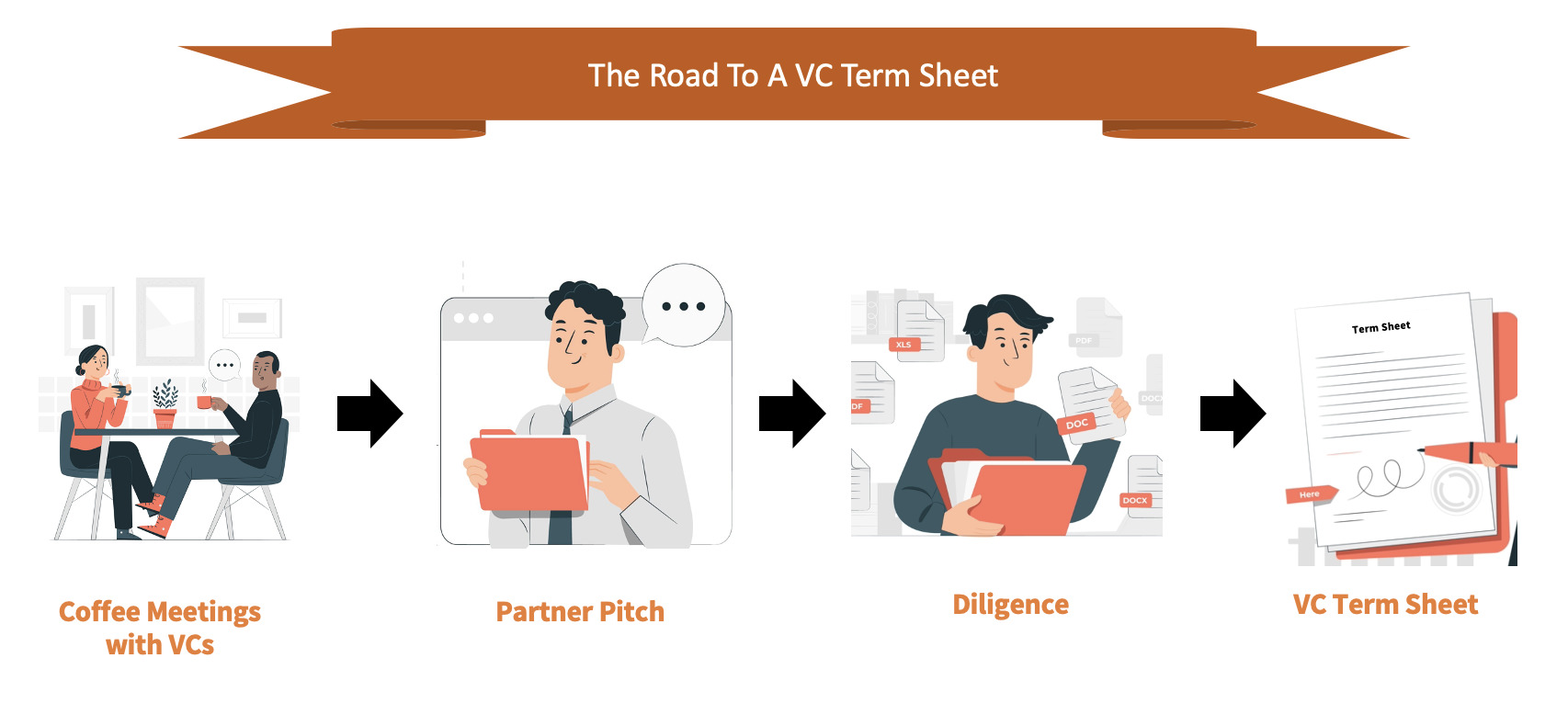

The Process of the VC Term Sheet

The road to obtaining a venture capital term sheet works like a funnel. In the early stages of raising capital, you are more likely to get a ‘No’ than a ‘Yes.’ The usual timeline from the initial pitch to signing the term sheet could be three to six months.

At each stage, VCs do their diligence to determine whether or not to continue. The speed at which investors follow up with you is a good indication of their level of interest in moving toward issuing a term sheet. The speed at which you respond to VC questions during the diligence phase is equally important and potentially affects their interest levels.

One of the founders’ most common questions is how and when to follow up with VCs. Should we follow up till they get a VC term sheet? The answer is pretty simple – follow up till you get a response, but don’t spam them.

Try to look busy, but don’t show that you’re desperate. This will turn off investors and could affect your ability to raise capital.

Download the Sample Term Sheet

Important Clauses in the VC Term Sheet

Clause 1: Pre-Money Valuation

This is the value of the start-up before the venture capital (VC) money comes in. Since most start-ups aren’t profitable in the early stages, the valuation is usually derived from a revenue multiple. In the case of pre-revenue start-ups, the valuation is more of an art than a science.

The valuation is generally based on the pre-money valuation of similar companies in the industry or other creative methods. Post money valuation is also a common factor that is mentioned in the term sheet.

- Founder Motivation: Increase the pre-money valuation. This will result in lower dilution

- VC Motivation: Decrease the pre-money valuation. This will result in a higher stake in the start-up.

- Win-Win: Agreeing to a common ground.

Clause 2: Anti-Dilution

Anti dilution protection is a part of the standard terms and conditions in VC term sheets. These protect early-stage investors from the risk of loss in their stake in case of a ‘down round.’ A down-round happens when the start-up raises capital (in the future) at a lower pre-money valuation than the current round.

Down rounds are standard when the start-up does not meet all or some of its milestones. These could be revenue targets, profitability targets, product launches, market share, etc.

- Founder Motivation: Narrow-based weighted average

- VC Motivation: Full-ratchet

- Win-Win: Broad-based weighted average

Clause 3: Liquidation Preferences

The liquidation section protects the investors’ interest in the long term in case of liquidation, bankruptcy, or sale. It sets out who gets paid first and how much they get in the event of a liquidation, bankruptcy, or a sale. By having liquidation preferences in a term sheet, investors protect downside risks by ensuring they get their money back before other investors. A 2x right means the venture capitalists will get 2x their investment before paying off the other shareholders.

- Founder Motivation: 1X liquidation right

- VC Motivation: 2X or more

- Win-Win: 1X is favorable to both the founder and the start-up

Clause 4: Founder Vesting

Founder vesting is the process by which founders “earn” legal rights to their stock over a period. This protects the start-up if one or more of their co-founders leave mid-way. Founder vesting ensures two principles, viz. incentivizing co-founders to stay with the start-up and watch the start-up in case one of them leaves.

In most deals, 50% to 80% of the founder’s stock is subject to vesting. A four-year vesting with a one-year cliff is a common trend in founder vesting.

- Founder Motivation: 100% vesting upfront

- VC Motivation: Delayed vesting over a 4-6 year period

- Win-Win: 4-year vesting with a one-year cliff

Clause 5: Board Rights and Voting Rights

The start-up is governed by the Board of Directors, a group of individuals chosen by the shareholders. The Board usually has the authority to make significant decisions for the start-up, such as:

- Recruitment of senior executives

- Dividends and appropriation of profits

- Further borrowings, equity raise

- Acquisition/disposal of substantial assets

- Expansion (such as overseas subsidiaries) related decisions

Many term sheet include a clause where a nominee director on the Board will be either a member (with voting rights in board meetings) or an observer (with no voting rights).

- Founder Motivation: 2-1 board with two founders and one investor

- VC Motivation: 2-2-1, which comprises two founders, two investor directors, and one independent director

- Win-Win: 1-1 equal composition (while this may not be practical in later stages where there would be several investors demanding board seats)

Clause 6: Drag-along and Tag-Along Rights

In the event of an acquisition, the buying company would want to acquire all the shares in your start-up. While the majority stakeholders can decide to sell their shares, they cannot legally force minority shareholders to do the same. This is where drag-along rights come in.

They prevent any situation where minority shareholders become a bottleneck to the transaction. With drag-along rights, the majority investors would have the legal right to “drag-along” the minority shareholders to the transaction.

While the majority shareholders have protection in the form of drag-along rights, minority shareholders have “tag-along” rights. This gives the minority shares a legal right to tag along (have their shares acquired on the same terms as the majority) with the majority stakeholders.

Clause 7: Exit Options

Most VC term sheets also have exit options clearly defined. These are usually strategic acquisitions or IPOs. The exit options clause defines what options would be available to the investors and when the investors can exercise these options.

Clause 8: No-Shop Clause

A no-shop is usually common in a term sheet template, that prevents the start-up from seeking investments from other investors/VCs. While this is a standard clause, you should closely look at the time when this clause is valid. A 30-day no-shop clause is not uncommon; however, longer validities could prove to be detrimental to the founder’s interests. This could also allow investors to take longer to finish their diligence and close the deal (or even drop out!).

Clause 9: Pre-Emptive Rights and Right of First Refusal (ROFR)

The pre-emptive rights help protect the VC’s rights in the case of a new offering of shares of the start-up. This gives them the right (but not an obligation) to participate in the further capital raise of the Company. ROFR, on the other hand, protects the investor from a secondary sale (i.e., a sale by one of the existing investors to other investors). This gives them the right to purchase the shares from existing investors before offering them to third parties.

Clause 10: Information Rights

Investor rights allow VCs and other investors to get specific information from the start-up regularly. This usually comprises of:

- Income statements

- Cash flows

- Balance sheets

- Updates on the financial performance vis-a-vis the business plan

- Key metrics and performance indicators

- Updates on ongoing/future fundraises

Things To Avoid In A VC Term Sheet

Some of the essential clauses in a VC term sheet are covered above. However, there are some common pitfalls that you should avoid:

#1: Redemption Rights

Redemption rights are something that many VCs push for. It gives the investors the right to sell some of their stock back to the Company at a specific price (“put-option”). Redemption rights are designed to protect investors from a situation where the start-up’s growth is stagnant, making it unattractive for an acquisition or an IPO exit.

The problem with redemption rights is that start-ups at that “stagnated” stage rarely have the cash to buy back the investors. There are also restrictions in many countries’ laws on the buy-back of shares if the Company does not have sufficient capital.

What should founders do? Redemption rights are essentially a non-starter. You should push back and knock them out of the term sheet. If the VCs insist on having redemption rights, you should reconsider if you want to work with such VCs.

If you are left with no option (due to lack of funds or interest from other investors), you should agree to it only after five years at a price equal to the investment price.

#2: Milestone-Based Financing

Milestone-based financing works where the VC and the start-up agree that the investment would come in certain milestones. From a VC perspective, this de-risks their investment and ensures that further capital is pumped in only upon achieving those milestones.

What should founders do? Milestone-based financing is not standard anymore in the valley and the rest of the world. Feel free to push back on these clauses if you see them in a VC term sheet.

Situations like the 2009 recession, COVID-19, the country’s political elections, and economic downturns usually put a plug on VC deals. Having the entire money upfront upon signing is always better than tying it to milestones.

#3: Legal and Other Fees

In some of the VC term sheets, it is not uncommon to find “monitoring fee” or “board fee.” These are fees that investors levy for their presence on the Board. As a founder, you should push back on these fees because they are unnecessary and unfair to the start-up. This could also hamper your future funding rounds.

What should founders do? Agreeing to legal fees involved in documentation and compliance with local laws is common. Some VC term sheets have due diligence and advisor fees, where they appoint third parties to review some of your legal and other documents.

As a founder, try to cap these fees to protect you from the downside if the deal doesn’t go through. Regarding “monitoring fee” and “board fee,” feel empowered to push back and knock them out of the term sheet.

Concluding Thoughts

A stage or a Series A term sheet is a non-binding agreement that usually have different clauses can be daunting and overwhelming for most start-ups. A lawyer and a CFO are a must in the entire process. A good lawyer will help you set up the deal properly, and a good CFO will ensure that it is prepared to make investments now and in the future.