What is a Convertible Note: Everything You Need to Know

Introduction

Convertible notes are incredibly popular and practical for raising funds by startups. But startup founders often don’t understand the mechanics and fundamentals of convertible notes. The truth is that most investors don’t want to invest in startups that don’t guarantee a significant return on investment. Startups are inherently risky!

From the perspective of startups, financial backing is crucial for any business to scale up operations, and this is where convertible notes come in. It is a hybrid instrument that is common in startups especially in early stages where valuations are not clear.

What Does It Constitute

A convertible note is a short term debt that converts into equity. Mostly, startups use convertible notes early stages – pre-seed, and seed rounds.

In the context of these notes, when the seed investors loan funds to a startup, they expect to get equity in the company rather than interest on the loan. These notes get converted into equity shares usually during the Series A round, when there is more traction, and valuations become clearer.

Contrary to naïve misconception, a convertible note is different from a promissory note. The primary aspect of issuing convertible notes is that it eliminates the need to arrive at the valuation of the startup during the funding stage. The pre-money valuation, in large part, comes into play at the time of Series A financing, when the actual conversion to equity happens.

A Hybrid Approach to Debt & Equity

Technically, convertible notes are structured to work as debt investments. However, a convertible note carries a provision that converts the principle accrued interest into equity at a specific date.

[monsterinsights_popular_posts_inline]

Key Terms

When it comes to reviewing convertible notes, the following key terms are important:

Valuation Cap

A valuation cap is the maximum valuation at which the note converts to equity. Investors put in a valuation cap in the term sheet to cap the valuation. If the valuation is capped (restricted to a smaller value), then they end up getting a higher stake in the start up. In hindsight, this gives convertible note holders some equity upside if the company’ valuation shoots up in the subsequent rounds.

Discount Rate

The discount rate is the rate that the convertible note investors receive on the valuation of the subsequent. Since convertible note investors are early investors, they take more risk by investing early. To compensate for this risk, they seek a discount on their valuation (Remember: Lower the valuation, higher the stake)

Maturity Date

It represents the date at which the note becomes due and the timeframe for the company to repay the note. Convertible notes come with a maturity date that makes them payable and due to the investors, assuming they haven’t converted to equity. Fortunately, a convertible note automatically converts at maturity.

Interest Rate

When you lend funds to a company, expect that these notes to accrue interest. And unlike when you pay back cash, this accrued interest ties together with the principal amount invested and increases the total shares issued during conversion. In reality, most of these convertible notes have a nominal interest rate such as 0.01%. Remember, the intent here is to not make money by way of interest, but to participate in the equity valuation upside.

The Need – For a Startup

A convertible note is one of the best debt instruments that helps startups get capital in a matter of days. It is a much better option than getting a bank loan, which can take a lot of time and involves endless paperwork.

Moreover, convertible notes cost companies minimal legal fees. On average, startups can expect to pay the equivalent of Rs.60K to Rs.150K as legal fee. However, when it comes to issuing preferred or common stock, it can cost an equivalent of Rs.2 lakhs to Rs.20 lakhs depending on the size of the round.

Unlike conventional debt structures, startups can use convertible notes to avoid paying back the principal with interest every month. It gives startups added flexibility to focus on running optimal and profitable business operations.

[monsterinsights_popular_posts_inline]

The Need – For an Investor

From the perspective of investors, there’s a significant upside to converting issued notes t. Typically, investors want their note to be part of preferred stock for taking such a big risk. In any case, investors use such notes for many reasons.

For instance, investors use convertible notes to negotiate suitable conversion terms. Since investors are taking the risk at an early stage – they use these notes to negotiate the best possible conversion terms. The focus is usually on a higher discount on a lower valuation cap. Also, investors utilize convertible notes to save their valuable resources and time.

Reduced complexity and costs allow investors to close deals quickly. With these notes, investors can likely expect to get interest payments convertible into equity. On top of getting back before SAFE holders and shareholders – convertible noteholders also have a higher liquidation preference.

Examples

A startup has two founders who collectively own 100,000 shares of common stock of Rs.10 each. The cap table before any external funding looks like this:

The startup raises a seed round of Rs.20 million in the form of a convertible note. For simplicity’s sake, let’s assume that the note carries 0% interest. At this stage, the cap table doesn’t get affected since a convertible note is a debt, till it gets converted to equity.

The startup has a good traction, and has launched its product. It has also found a product-market fit, and has a VC firm willing to do a Series A round of Rs.100 million round at a pre-money valuation of Rs.500 million.

[monsterinsights_popular_posts_inline]

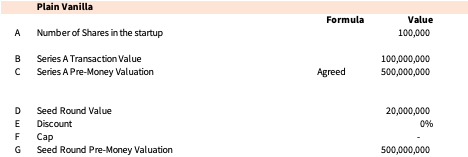

Illustration #1: Plain Vanilla

Let’s assume a plain vanilla option where the convertible note gets converted at the same valuation as that of the Series A round. There are no caps and discounts.

As a first step, the seed investors convert at their agreed valuation of Rs. 500 million

Once the seed investors get converted into equity, the next step is to issue shares to the Series A investors:

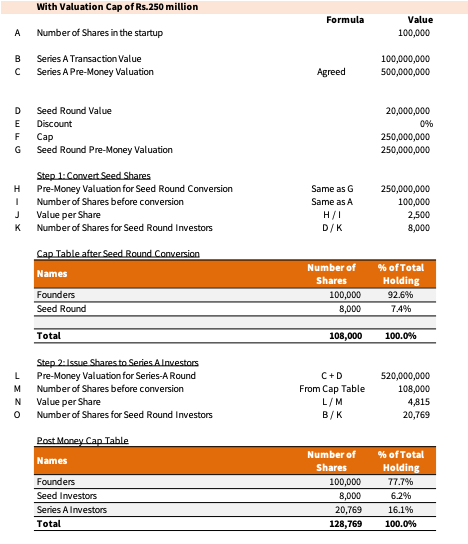

Illustration #2: With Valuation Cap

In this scenario, let’s assume a valuation cap for the convertible notes, where the note gets converted at the Series A valuation with a cap of Rs.250 million. In our case, since the Series A valuation is Rs.500 million (which is more than the cap), the seed investors will get their shares at the cap valuation of Rs.250 million.

[monsterinsights_popular_posts_inline]

Illustration #3: With Discount

In this scenario, let’s assume no valuation cap, but a discount of 20% to the Series A Round. In our case, since the Series A valuation is Rs.500 million (which is more than the cap), the seed investors will get their shares at a valuation of Rs.400 million (i.e. a 20% discount).

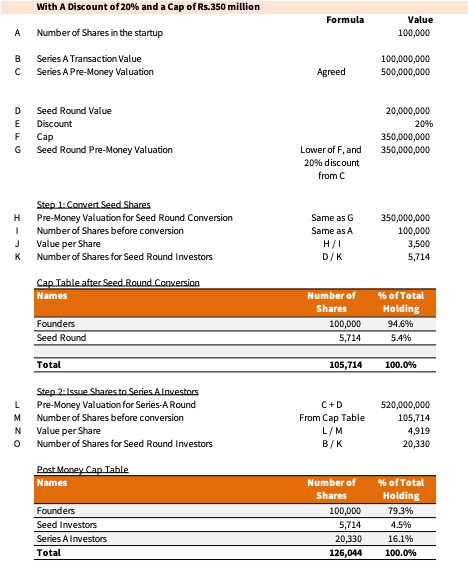

Illustration #4: With Discount and Valuation Cap

Now let’s look at a scenario where there is a discount, and a valuation cap. Let’s assume a discount of 20% and a valuation cap of Rs.350 million.

In our case, since the Series A valuation is Rs.500 million (which is more than the cap), the discounted valuation would be Rs.400 million (i.e. 20% discount). However, since we have a cap of Rs.350 million, the cap will kick-in, and the valuation for the purpose of conversion of the seed round will be Rs.350 million.

Benefits and Downsides

Investors and companies are aware that many pros and cons are attached to convertible notes. But once you understand the uniform structure, use cases, and subsequent results of using a convertible note, it comes across as a useful financial instrument to both parties.

When it comes to getting venture capital, here are the essential benefits and downsides of using convertible notes.

Benefits

- They make negotiation cheaper, easier, and faster for investors than funding rounds that mandate businesses to provide a significant valuation.

- They are perfect for startups that have no expansive financial history.

- They put startups at ease and don’t give complete control to investors to make business decisions in the early stages.

- They are a safe option for investors than having to deal with regular equity, which comes with many prerequisite terms and conditions.

- Ideal for high-growth startups and renders a high return on investment for investors.

Drawbacks

- One of the downsides of convertible notes is that it bears a high failure risk.

- For investors, calculating the proper return on investment is highly complex than conventional loan ROI. Investors have to consider discount rates, maturity dates, valuations, and interest rates.

- If the company fails to raise equity financing later on, it may not have enough funds at the time of maturity to cover the note. Also, the valuation game could become very complex.

- If the equity rounds fail to complete, the convertible note would continue to be a debt and require redemption. And this will ultimately push fragile and vulnerable companies to face bankruptcy.

- Clauses like conversion discounts and valuation caps can create complexity to raise future equity and manipulate price expectations.

[monsterinsights_popular_posts_inline]

When Does It Mature

Both investors and companies want the convertible note to work out and that means conversion into equity when it hits maturity. In an ideal scenario, the conversion usually takes place between 18-36 months.

Convertible notes can support a variety of scenarios and conditions. For instance, startups can use convertible notes to get capital for marketing, hiring personnel, and product design and development.

Since such notes carry a high risk on investment, investors expect a huge reward. If the company fails to repay or convert the loan by the time the convertible note matures, it opens up a few options.

First, investors might decide to extend the convertible note’s maturity rate in the hopes of securing the funding on time. Second, investors may decide to negotiate the terms of the convertible note. In this case, investors can ask for a lower cap or get a considerable discount, so that they end up getting a higher stake!

Who Does This Suit?

Convertible notes work wonders for companies that want to raise capital between substantial equity rounds. Mostly, convertible notes are suitable for startups in the early stage that are in the position to grow quickly. After all, these startups have the best shot at getting seed funding through convertible notes.

But the burden of responsibility lies on startups to strategically plan a clear path to increase company valuation and accelerate conversion without issues. It is the main reason most startups leverage notes in the early stage.

Most investors prefer to check the potential valuation before finalizing terms and conditions. Traditionally, startups would need more time to step up the business valuation in the early stages and acquire Series A funding. But through convertible notes, startups can get the required capital and get the ball rolling.

[monsterinsights_popular_posts_inline]

Final Thoughts

Overall convertible notes are a solid option for investors and companies. When dealing with a high-reward and high-risk model, startups can tap into convertible notes to get the required seed funding before opting for Series A funding.

Part of the process is to have a clear plan of action and anticipate all eventualities. It is the best approach for both investors and startups to make the most out of a business arrangement.

The key is to follow the right practices of issuing such notes. It means issuing notes only after reviewing all your available options. Apart from convertible notes, startups can explore other funding options like SAFE notes, convertible preference shares, bank loans, KISS notes, and third-party grants.

Negotiating a term sheet with investors can be a daunting task for a founder. That is why you need a lawyer, and a startup-CFO to help navigate these challenges. The wise course of action is to review all alternatives and then make a logical and calculated decision that works in the best interests of both parties.