What is Anti-Dilution? Why Is It Important to Founders

Anti-Dilution clauses are standard in term sheets when you raise capital for your startup. Many founders sign term sheets without knowing the implications of anti-dilution provisions. So, what is anti-dilution? This article will examine the three anti-dilution requirements and how each impact you as a founder.

What is Dilution?

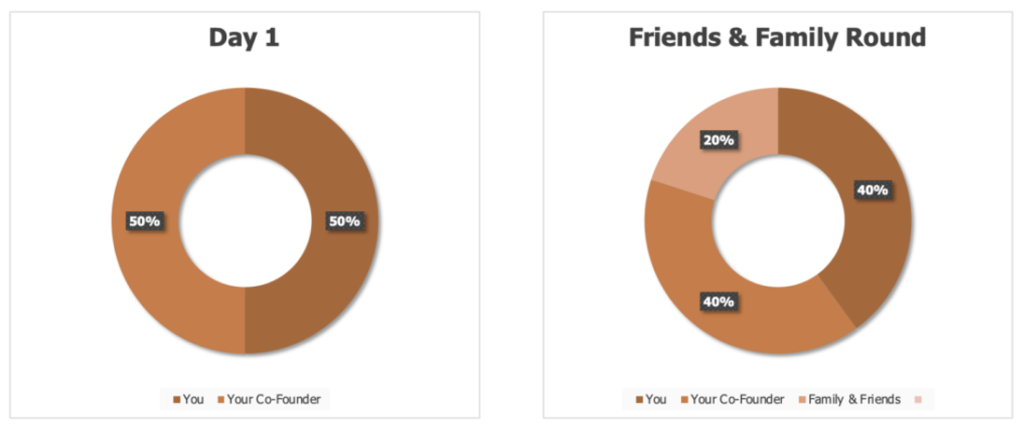

To fully understand the meaning of “anti-dilution,” you must first understand the meaning of dilution. When new investors come in, dilution happens when your startup ownership reduces. For example, you and your co-founder own 100% of your startup.

When your startup is six months old, you realize the need for additional capital to keep your startup afloat. You do a ‘friends and family’ round to raise $200,000 by giving away 20% of your startup. So, you have “diluted” 20% of your stake in your startup by raising $200,000.

Under normal circumstances, your startup continues to raise capital, and the value of your startup continues to grow. The friends and family who invested $200,000 in the first round will dilute their 20% stake as newer investors come in at a higher valuation.

However, in cases where your startup’s valuation decreases in the future, the early-stage investors are put at risk because they are diluting a higher proportion of their ownership. Anti-dilution provisions allow investors the right to maintain their ownership percentages when you issue new shares at a lower valuation.

What is Anti-Dilution

Anti-dilution clauses are standard in preferred stock rounds, where the existing investors look to protect their interests in a later funding round, especially in a “down-round.”

Let’s say your startup is looking to raise $500K. It is doing OK but not too great. It has achieved certain milestones, but the growth rate is far less than what the industry peers have achieved.

As a result of the slower growth, the founders have not been able to convince the investors to get a higher valuation than the previous round. Moreover, because of specific changes in the economic situations post-COVID, the new investors will only agree to a down round.

Raising capital at a lower valuation is an example of a down-round. If the founders go ahead with this round, the existing investors will effectively own a smaller percentage of the company.

The anti-dilution provisions in the term sheets protect the existing shareholders from the effects of this down-round. Unfortunately, the founders will have to bear the full brunt of these provisions, so you need to understand how this works.

[monsterinsights_popular_posts_inline]

Three Types of Anti-Dilution

Three types of anti-dilution provisions are common in venture capital term sheets:

No Anti-Dilution

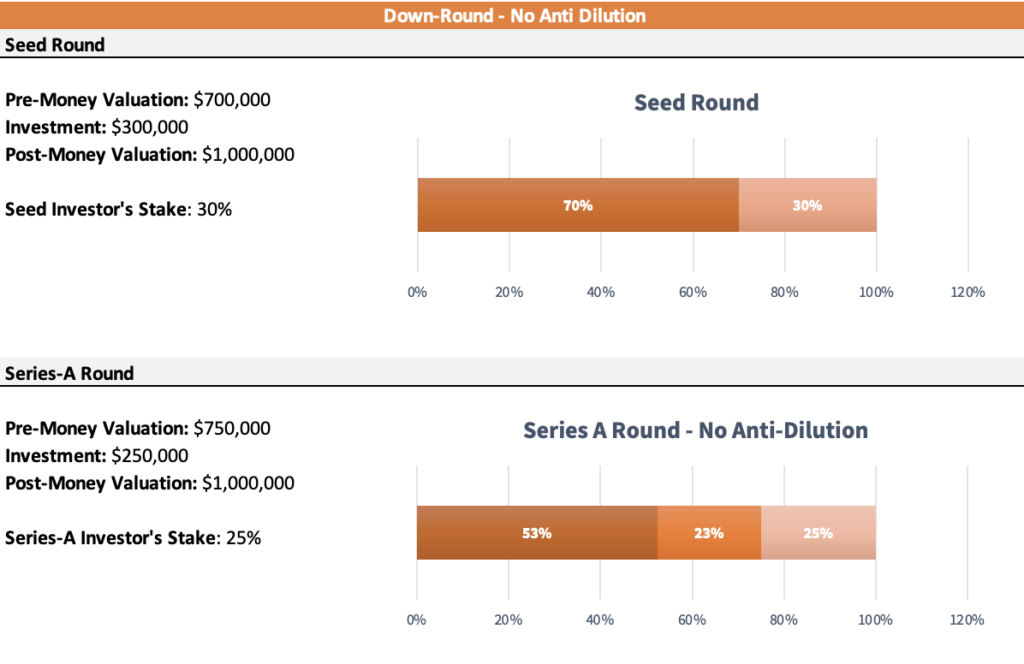

Where there are no anti-dilution provisions, the existing preferred shareholders will share whatever dilution takes place in the event of a down-round. Let’s look at an example:

Where there are no anti-dilution provisions in the seed round term sheet, founders and seed investors would have to sacrifice their stakes in proportion to their shareholding. In other words, the earlier investors have no protection in case of a down-round.

Full Ratchet Anti-Dilution

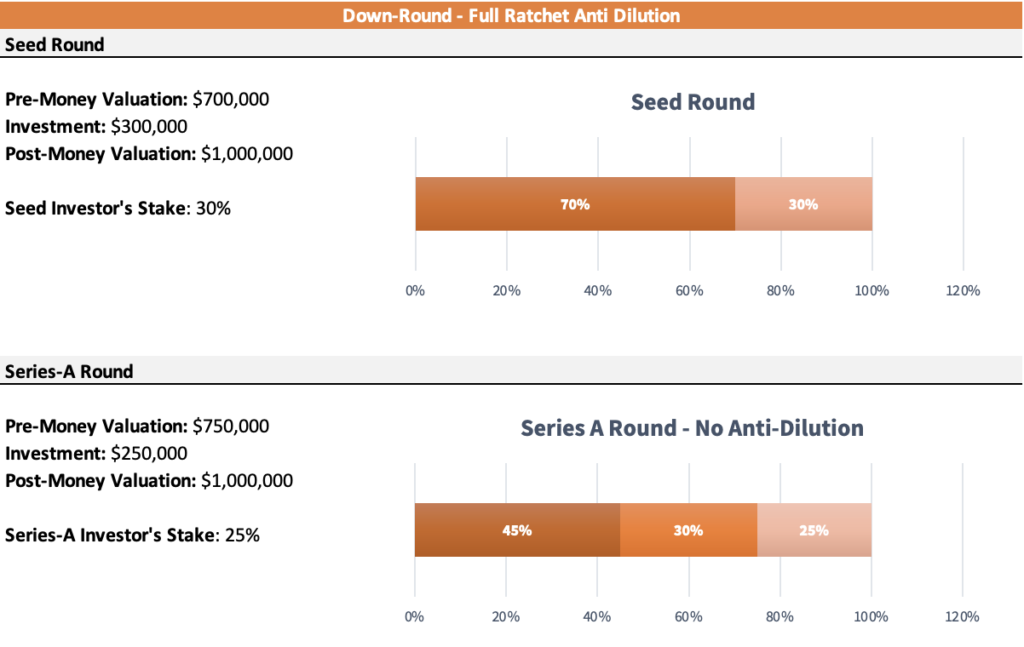

In a full-ratchet anti-dilution scenario, the ownership interests of the earlier investors are fully protected. Therefore, the founders will bear the full brunt of the reduction in valuation.

In the case of full-ratchet anti-dilution protection, the incoming Series-A investors will get their total stake (in our example – 25%). The current preferred shareholders will maintain their ownership percentage (in our example – 40%).

When the company issues common stocks during a liquidity event, the company will adjust the conversion ratio of the preferred shares so that these investors maintain a 40% stake. The founder’s shareholding will reduce to 45% (balance) of the overall stake. A full-ratchet anti-dilution clause is the most unfavourable to the founders.

Weighted Average Anti-Dilution

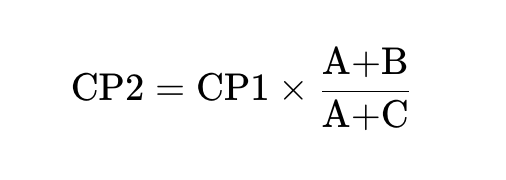

Weighted average anti-dilution provisions consider the number of additional shares being issued and adjust the conversion price based on a weighted average of the old and new prices. This can dilute the ownership percentages of all shareholders in a company, but to a lesser extent than a full ratchet anti-dilution provision.

Weighted average anti-dilution provisions are less favourable to shareholders than full ratchet provisions. Still, they are often considered a “mid-way” between no anti-dilution and full ratchet.

The weighted average formula takes into account the following factors:

- Price per share

- Money previously raised

- Money being raised in the new round

- Price per share in the new round

The formula is:

Where:

CP1 = conversion price before the dilution

CP2 = new conversion price

A = number of shares (i.e. before the dilution)

B = number of new shares that would have been issued if the conversion price before CP1 is applied

C = number of new shares actually issued

There are two types of weighted average anti-dilution based on the number of outstanding shares: broad-based and narrow-based. The broad-based method counts the stocks reserved for issuance for stock options and warrants, whereas the narrow-based does not. The narrow-based method includes only common and preferred shares outstanding.

Including the additional shares in the broad-based weighted average formula reduces the magnitude of the anti-dilution adjustment. So, broad-based anti-dilution is often seen as the most founder-friendly provision.

Negotiating Anti-Dilution Provisions

When negotiating these provisions, it’s crucial for both the company and the investors involved to carefully consider the terms of the provisions and how they will affect the value of their ownership percentages.

Some key factors to consider when negotiating anti-dilution provisions include the type of provision (such as weighted average or full ratchet), the event or events that will activate the provisions, and the specific terms of the adjustment to the conversion price.

Both parties should also consider the potential impact of the provisions on the company’s future financing options. For example, if the company has full ratchet anti-dilution provisions put into place, it may be more difficult for the company to raise additional capital in the future.

On the other hand, if the term sheet does not have any anti-dilution provisions implemented, investors may be less willing to invest in the company in the first place. Moreover, anti-dilution provisions are not common in SAFEs because the valuation cap or discount rate already serves the same purpose.

[monsterinsights_popular_posts_inline]

Why Is Anti-Dilution Important for Founders?

Anti-dilution provisions are very important for the founders of a company because they protect the value of the founders’ ownership in the company. When a company issues additional shares, it dilutes the ownership interests of all shareholders, including the founders.

The broad-based weighted average is the founder’s favourite because they act as a golden bridge between the full ratchet and no anti-dilution scenario. As a founder, you should expect many investors to propose these provisions.

As a founder, you should constantly scrutinize the term sheets and shareholder agreements to check the anti-dilution provisions. If you don’t foresee a down-round, these provisions may not come and haunt you. However, down-rounds have become common in the current global economic scenario, and you should expect anti-dilution clauses to kick in many startups.

If you are looking for professional help in negotiating your term sheets, you should appoint a lawyer or a Virtual CFO who will negotiate these terms on your behalf.