Due Diligence Services

Due diligence services are commonly used by investment bankers, and investing partners to obtain a comprehensive, independent and sophisticated report on the target’s credentials.

At KayOne Consulting, our team is trained on understanding key risks, value drivers, potential synergistic opportunities in the transaction. We have significant experience in working with domestic and international clients to maximize value in a transaction through ensuring a smooth due diligence process.

Whether it is for an investment, acquisition, sale or hive-off, we customize our due diligence services to meet your specific needs.

What do we do?

-

Financial

Due Diligence -

Tax

Due Diligence -

Compliance

Due Diligence -

Operational

Due Diligence

KayOne Consulting has helped board of directors and shareholder appointed committees of companies across the spectrum in a wide range of industries. We provide fairness opinions in the case of:

- Mergers & acquisitions

- Corporate restructuring

- Management buy-outs and divestitures

- Going-private transactions

Our team of experienced consultants follow a well-documented, and professional to arrive at the most scientific and defensible valuation opinion for your business or any transaction.

KayOne Consulting’s valuation reports have continuously withstood the highest levels of scrutiny from third party lawyers, auditors, and the IRS requirements.

- 409A Equity Instruments

- Estate and Gift Tax

- C-Corp to S-Corp Conversions

- Wealth transfer

Our team of experienced consultants follow a well-documented, and professional to arrive at the most scientific and defensible valuation opinion for your business or any transaction.

KayOne Consulting’s research backed valuation approach helps you evaluate your intellectual property, and intangible assets.

Our experience spans across a wide variety of technological assets including patents, brands and trademarks

- Mergers & acquisitions

- Corporate restructuring

- Management buy-outs and divestitures

- Going-private transactions

Our team of experienced consultants follow a well-documented, and professional to arrive at the most scientific and defensible valuation opinion for your business or any transaction.

KayOne Consulting’s valuation reports have continuously withstood the highest levels of scrutiny from third party lawyers, auditors, and the IRS requirements.

- 409A Equity Instruments

- Estate and Gift Tax

- C-Corp to S-Corp Conversions

- Wealth transfer

Our team of experienced consultants follow a well-documented, and professional to arrive at the most scientific and defensible valuation opinion for your business or any transaction.

Whom do we work with?

Angel/PE/VC Funds

We have worked with several angel investors, private equity funds, family offices, and venture capital firms to help them evaluate their target investments.

Buyers and Acquirers

We work closely with buyers and acquirers at every stage of the transaction, helping identify value drivers, risks and opportunities involved.

Sellers

We help unlock hidden value as our clients sell or hive-off their non-core businesses.

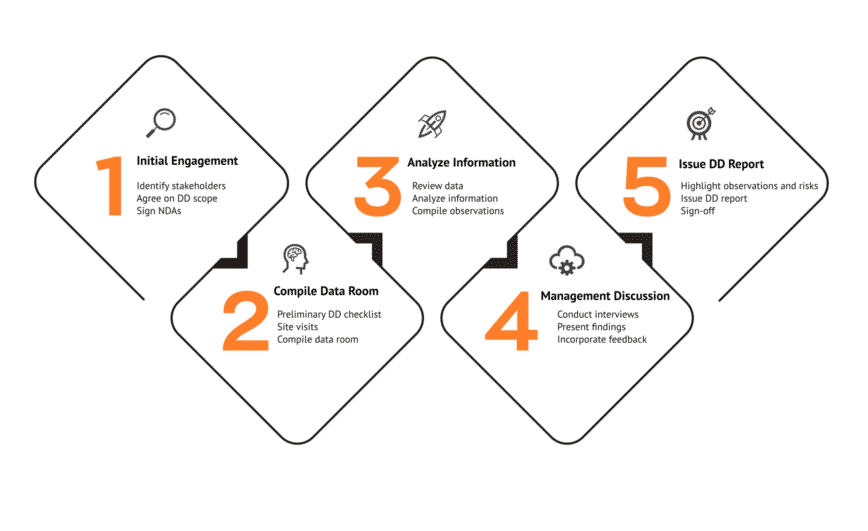

How does it work?

KayOne’s well defined, yet flexible process helps our clients uncover key transactional issues. We work closely with the stakeholders throughout the transaction, in order to ensure smooth transition and timely reporting.

Recent Transactions

What do our clients say?

Very timely

Working with KayOne Consulting was more than satisfactory. The team is very talented, in multiple varying aspects. The work that they delivered was thoroughly developed and well studied. They are well-rounded, and their strategy to collect information is smart, very timely and straight to the point. I highly recommend them.

Bassam Loucas

Co-Founder Conundrum TechGood Experience

Working with KayOne Consulting was a good experience. They were professional in every aspect of this project, and their responsiveness was exceptional. I have no regrets awarding them this project. I have a few more in mind and will definitely look forward to working with them in the future.

Ryan Mollun

Sales Director Rox TanExtremely Professional

Priya was extremely professional and produced an outstanding business plan which exceeded my expectations! I was very impressed with her market research of the Australian Market and excellent work ethic! Thanks team Kayone

Laura Fullwood

OwnerGlad to be working with you!

Well, the work you have done could not be appreciated with simple words. You created our valuation report from scratch and detailed it. The quality of work, the trust feeling you give to clients are on a high level. This open attitude, honesty and support continues whole throughout the project. This is a start for me, and I am glad I engaged you. Project completed successfully.

Mark Deroty

CEOTrustworthy and Professional Relationship

I am fortunate to establish a trustworthy relationship with Kishore and KayOne Consulting. I have hired them before and will continue to hire them. I really appreciate the time spent on Skype to discuss the details.

Michael Sueoka

CEO Curb StreetOne of the best!

KayOne was fantastic. My contact was always available, very knowledgeable and extremely professional. I am working with them on multiple projects, and will continue to work with them again!

Deborah Scarpa

CEO DJS 3S0P LLCExcellent work!

Excellent work. Professional, precise and very dependable.KayOne was a pleasure to work with and all work was performed at a superior quality, on time and on budget. Will definitely work together again!

Danny Yohannes

CEO Spinvi100% Satisfied

Great consultant, extremely professional! Very happy with the work. Has gone the extra mile to ensure that I am 100% satisfied.