Interim CFO Services

Every business undergoes periods of transformation at some point with several issues popping up at the same time. These could be accounting errors, financial management issues, scaling up issues, technology issues or process issues.

It is at times like these that you need a skilled expert, someone who can cast a trained eye on your profitability, working capital, cash flow, and other key performance indicators while you concentrate on building your product, hiring your team and focus on scaling up for growth.

Our Interim CFO services are used to provide the top management with financial strategy and business skills for a short period of time (usually less than six months).

Our Interim CFOs come in full-time basis and help you steer a company through a financial crisis, an operations change, preparation for a sale, or fill the gap between one CFO’s departure and the hiring of a new one.

What do we do?

-

Investor

Reporting -

Compliance

Review -

Financial

Management -

Budgeting and

Controls -

Transactional

Support

If you have external investors on board, it is important that you have a dedicated team to manage and liaison with these investors. Each investor may have their own reporting structures, and information requirements. Our team will help your company manage external investors by sending them periodic financial updates and reports.

- Monthly MIS

- Capital raise follow up

- Adhoc reports for the investors

- Quarterly strategic and business updates

Our team of experienced consultants follow a well-documented, and professional approach to managing external investors and lenders.

Our team brings a 360° compliance management to your business by keeping track of various compliance requirements applicable to your business. We cover the following aspects in our ongoing compliance review:

- Company law and corporate governance

- Income tax and TDS

- Goods and Service Tax

- Employee labour laws - EPF, ESI, LWF

- Foreign Exchange Management Act, 1999

- Covenants in loan and investor agreements

Our team ensures on time compliance with all relevant statutory laws that are applicable to your business.

Running out of capital is the second biggest reason why most businesses fail. The primary role of a chief financial officer in any organization is to oversee the financial management function, maintain and report on the financial activities of the business.

Our expert CFOs help you manage funds to ensure that your working capital levels are optimally managed. More specifically, these include:

- Cash flow management

- Receivables and collection

- Payables and vendor payments

- Fund management and treasury operations

Budgetary controls are one of the most commonly used checks put in place to ensure that your business is not spending more than what it is supposed to. The objective is to give you enough leeway such that you can capitalize on any opportunities that emerge, and focus on growth.

- P&L budgets

- Cash flow budgets

- Cost-sheet variance

- Group-level consolidated budgets

Our team of experienced consultants follow a well-documented, and professional approach to ensure that you stay on top of your numbers.

Our transactional support services provides you with traditional accounting services such as month-end financial statements, bank reconciliation, and management reporting.

- Month-end adjusting entries

- Reconciliations

- Transactional entries

- Trial balance generation

We’re not just a team of bookkeepers and accountants. Our team goes beyond the traditional day-to-day book keeping by laying a solid foundation to help your business grow to the next level.

Whom do we work with?

Formation Stage

We have worked with several start-ups helping them get their finances in order. Typically companies at this stage would like to have a foundation setup for them to expand and sustain their business.

Validation Stage

We’ve worked with mid-stage companies to help them develop financial strategies for growth. Businesses in the validation stage also require support in terms of establishing policies and controls for helping them scale up.

Growth Stage

We help growth stage companies maintain their cash flows, manage their working capital, and external investors and lenders.

How does it work?

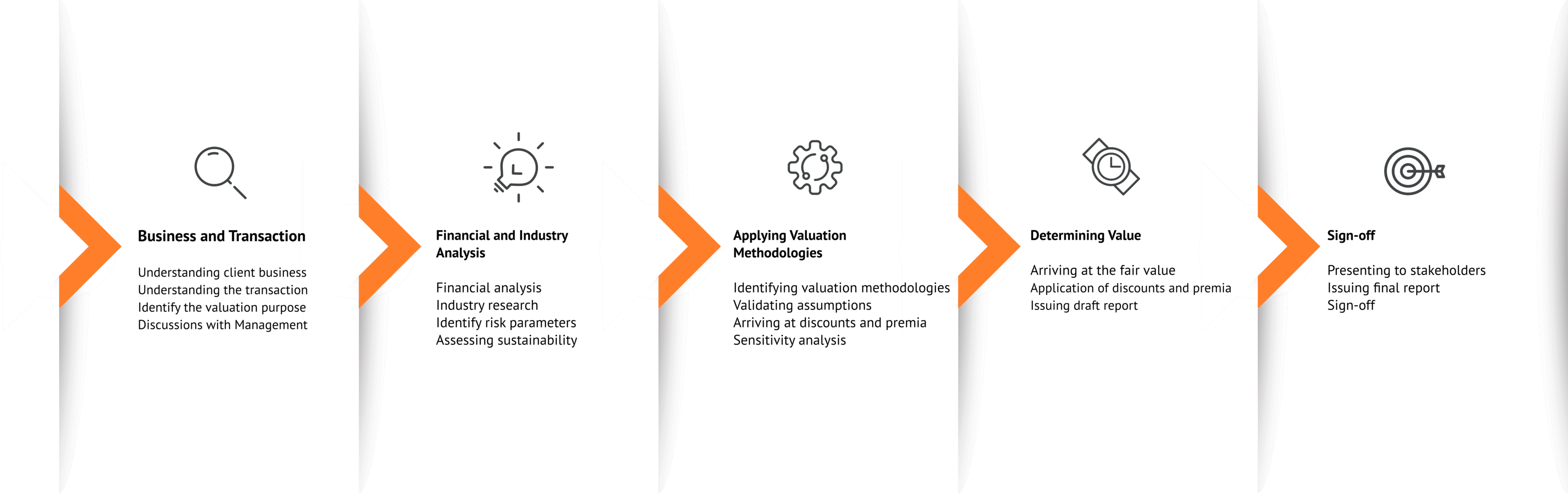

KayOne’s well defined, yet flexible process helps our clients uncover key transactional issues. We work closely with the stakeholders throughout the transaction, in order to ensure smooth transition and timely reporting.

Recent Transactions

What do our clients say?

Very timely

Working with KayOne Consulting was more than satisfactory. The team is very talented, in multiple varying aspects. The work that they delivered was thoroughly developed and well studied. They are well-rounded, and their strategy to collect information is smart, very timely and straight to the point. I highly recommend them.

Bassam Loucas

Co-Founder Conundrum TechGood Experience

Working with KayOne Consulting was a good experience. They were professional in every aspect of this project, and their responsiveness was exceptional. I have no regrets awarding them this project. I have a few more in mind and will definitely look forward to working with them in the future.

Ryan Mollun

Sales Director Rox TanExtremely Professional

Priya was extremely professional and produced an outstanding business plan which exceeded my expectations! I was very impressed with her market research of the Australian Market and excellent work ethic! Thanks team Kayone

Laura Fullwood

OwnerGlad to be working with you!

Well, the work you have done could not be appreciated with simple words. You created our valuation report from scratch and detailed it. The quality of work, the trust feeling you give to clients are on a high level. This open attitude, honesty and support continues whole throughout the project. This is a start for me, and I am glad I engaged you. Project completed successfully.

Mark Deroty

CEOTrustworthy and Professional Relationship

I am fortunate to establish a trustworthy relationship with Kishore and KayOne Consulting. I have hired them before and will continue to hire them. I really appreciate the time spent on Skype to discuss the details.

Michael Sueoka

CEO Curb StreetOne of the best!

KayOne was fantastic. My contact was always available, very knowledgeable and extremely professional. I am working with them on multiple projects, and will continue to work with them again!

Deborah Scarpa

CEO DJS 3S0P LLCExcellent work!

Excellent work. Professional, precise and very dependable.KayOne was a pleasure to work with and all work was performed at a superior quality, on time and on budget. Will definitely work together again!

Danny Yohannes

CEO Spinvi100% Satisfied

Great consultant, extremely professional! Very happy with the work. Has gone the extra mile to ensure that I am 100% satisfied.