How Do VCs Make Money and Why It Matters to You

A venture capital (VC) firm is a financial institution that invests in early-stage companies with long-term growth potential. How VCs make money is a question of interest to many entrepreneurs and business owners, as it can help explain why venture capitals are such an essential part of the startup ecosystem. With that in mind, let’s look at how VCs make money and why it matters to you as an entrepreneur.

The Role of VC in Startups

The role of venture capital in startups has changed dramatically in the past few years. In the past, VCs were very hands-on with their startups, and they would often be on the board of directors and would be heavily involved in the day-to-day operations of the company. However, as the role of VCs has evolved, so has their investment process.

Nowadays, venture capitalists are much more selective in their investments. They want a strong business plan and a clear path to profitability. They also want to see a good team and culture within the company. Venture capitalists are not just interested in the money the company will make; they’re also interested in the company’s impact on the world.

A growing number of startups are turning to venture capitalists for help getting their businesses off the ground. A VC investment can help finance the initial stages of a business and provide the capital needed to grow the company. In many cases, a venture capital investment can help to secure the company’s future.

What are General Partners and Limited Partners?

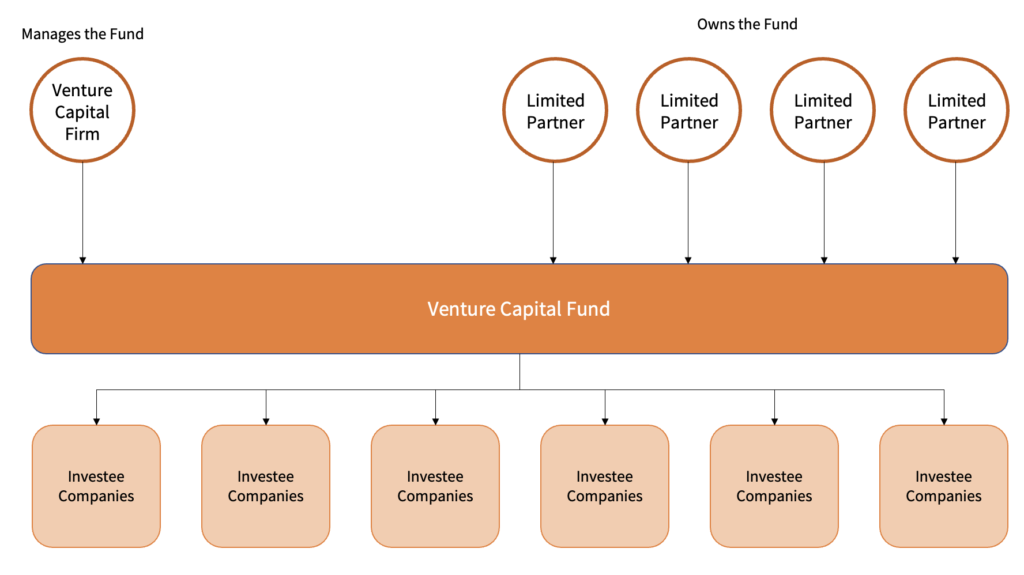

In order to understand how VCs make money, we need to understand the fund structure. A venture capital fund typically comprises two essential components: general and limited partners. The general partners are responsible for selecting investments, reaching agreements with firms and startups, and assisting entrepreneurs in expanding and achieving their objectives. Limited partners, on the other hand, are the individuals, pension funds, and entities that contribute the money required to fulfil such investments. In other words, limited partners contribute the money while general partners undertake the investments.

One of the main distinctions between venture capital funds and other alternative investments is that they invest in limited partners’ funds instead of their own partners’ funds. General partners can invest some of their own money in the fund. However, this amount is usually less than 1% of the fund’s total size.

Startups must raise money to persuade venture capital companies, business angels, etc., to lend them money in return for stock. The same may be said for venture capital companies. The fund’s general partners must persuade a few of the businesses mentioned above to put money into it by promising them a significant return on investments over a specific length of time, which is generally ten years.

The venture capital businesses must then make astute investments to return the limited partners’ money plus a profit.

How Do VCs Make Money?

There are two ways venture capitalists make money – The first way is through a management fee for the investment funds they manage. The second way is through a carried interest or carry, which is a share of the profits earned by the company after the initial investment.

Management Fees

Management fees are determined as a percentage of the fund’s value each year. A venture fund is a collection of money put together by high-net-worth individuals, insurance companies, retirement funds, investment banks, endowments, and other financial institutions. After they raise a fund, top tier firms usually charge a management fee to investors, which is generally 2% of the investment value each year.

Imagine that a venture capital raised ₹100 million in a VC fund, then the management fee would be ₹2 million (₹100 million x 2%). This fee helps cover the cost of paying partners and associates, accounting, employees, audits, taxes, and any cost that may be incurred while managing the fund.

Management fee revenue increases when an investment firm manages several different funds simultaneously. Nowadays, VC firms usually start a fund every two or three years, and the fund’s existence will be for seven to ten years. They typically charge management fees for multiple funds at the same time.

When it comes to management fees, there is generally a moment throughout the venture capital fund’s existence when VCs will reduce those fees annually, starting at the end of the active investment period. An annual 2% fee may be decreased each year up to the day the fund is completely closed.

Using the example of a ₹100 million VC investment, the VC company may earn ₹2 million in the first three years. The charge may drop 20 basis points to 1.8% in year four, at which point the VC firm receives management fees of ₹1.8 million (₹100 million x 1.8%).

Management fee rates will be dropping by as much as 20 basis points per year, from 1.6% in year 5 to 1.4% in year 6, and so on, but they often don’t go below 1% until the fund’s termination date. At any given time, the VC company could have two to three funds that cover the entire 2% management fee and other funds that are no longer active and pay smaller management costs.

Carry Interest or Carry

Carry interest refers to the amount of ownership a VC firm receives as part of a venture capital agreement with a startup. This is one of the significant ways in which VCs make money. Typically, the contract is written so that the venture capital company will receive a portion of any profits once the fund’s assets begin to be dispersed back to the fund investors. The majority of carries are 20%; however, a very successful business with a proven track record may be able to negotiate a larger carry.

Using the same example as before, once the fund has approached its end date, the firms may have successfully exited and been sold to acquirers, or they may have staged an IPO, and the fund’s investments are now valued at ₹200 million. The VC firm’s carry after the original ₹100 million has been delivered to the investors would be ₹20 million, or 20% of a ₹100 million gain. This is a considerably larger source of income for the VC company.

A more significant portion of the carried interest is distributed to partners inside the company, while a lesser percentage is distributed among other employees. In the case of a ₹20 million carry, the partners may share 80%, or ₹16 million, and the additional 20%, or ₹4 million, might be given to other employees at the venture capital company. This pushes the team to make sound judgments, collaborate with portfolio companies, and assist startups in becoming successful.

How does the Government regulate VC?

In India, venture capital is regulated by the Securities and Exchange Board of India (SEBI). SEBI is responsible for protecting the interests of investors and ensuring that the venture capital industry operates fairly and transparently. SEBI also oversees the functioning of the venture capital industry by issuing guidelines, making rules, and investigating violations.

One of the essential things that SEBI does is to protect investors. It has strict guidelines for managing venture capital funds, and it requires that all fund managers adhere to those guidelines. In addition, SEBI oversees the registration of venture capitalists and monitors their activities.

Suppose you are an entrepreneur looking to raise money from a venture capital fund. In that case, you need to ensure that your company is registered with SEBI and that your venture capital firm complies with all of the regulations. This will help ensure that your investment is safe and that you work with a reputable organization. The regulatory framework for venture capital in India is complex, and it is essential to understand it if you are interested in raising money from a venture capital fund.

Pick Your Investor Wisely

All venture investors have the same overarching goal: raise their next round of funding. Having a properly run fund can provide predictable and regular income to investors. If they invest in several different actively managed funds, the income stream can be enhanced even more.

Venture capitalists must demonstrate traction to get a successful fundraiser. Traction in the venture capital industry is represented by liquid capital returns that are more than the size of their fund or, more commonly, the potential to repay their fund many times over.

Suppose you are an aspiring entrepreneur looking to raise capital. In that case, you need to be as strategic as possible in building a team to recruit investors to help you with a fundraising project. You need always to remember as well that size does matter. The fund size from which you are making your investment, the investment size you are requesting, and the valuation you want to get for that investment are all data points that reveal an investor’s behaviour. Now you know that VCs make money by way of carried interest and management fee.

Double consider working with a large company to raise money when you are looking at making a capital raise for your company. A large fund can pose some problems if a financially attractive sale opportunity suddenly arises at the beginning of the company’s life cycle. In your investment agreement, investors typically include a blocking power that allows them to approve or disapprove a sale or even future fundraising for your business.

Additional Thoughts for VC Firms

It’s critical to keep in mind that not every entrepreneur succeeds when analyzing VC returns. Therefore, even while a successful business might have a substantial upside, it’s virtually guaranteed that the VC fund also has other firms in its portfolio that weren’t successful.

Therefore, if a venture capital fund hits a home run with one firm, its success must be weighed against other businesses that didn’t do as well. Another option is that some VC funds, including prominent or even tiny funds managed by good venture capitalists, could bargain for higher management fees.

You will better understand the criteria that venture capital companies use to choose investments if you know how they generate their revenue. They primarily search for significant victories with good returns to help them carry the bet.

Additionally, the investors in such VC funds have the same objectives. And while a competent venture capital firm would take care of every business in its portfolio, there are times when it will concentrate on the two or three that have the highest possibilities of success since they will provide the most profit for their investors. As you know by now, VCs make money by focusing on high growth startups.

A solid venture capital company that supports your startup might be pretty beneficial. As a founder, you desire to collaborate with a venture capital firm that shares your corporate goals and values. Other tools that we offer to businesses seeking funding include our templates for VC pitch decks and free financial projections for startups.

With these points in mind, it is clear that understanding how VCs make money and why it matters to you is an integral part of understanding the venture capital process. When evaluating a potential venture capital partner, it’s essential to understand their financial motivations and how those motivations might impact your startup.