All You Need To Know About Liquidation Preference

In this article, we focus on a very important section in the term sheet – Liquidation Preference. Equity investment inevitably involves a significant element of risk. Since the risk involved in equity investment is significant, the likelihood of earning high returns on investment is also huge.

That’s why investors want look to invest in equity as it can give them huge upside in case the company makes a successful exit. Exit in this case typically refers to the sale of shares either through an IPO or a merger.

A key element of an investor’s ROI is his ability to recover the invested amount on a liquidation event. Such a preference given to investors in the event of liquidation enables them to participate in the upside. Also, it gives them the benefit of being better protected relative to the other shareholders against the downside. Such a preference is called a “Liquidation Preference”. It is one of the most common provisions found in venture capital term sheet.

In this article, we are going to discuss what is liquidation preference.

What Is Liquidation Preference?

A liquidation preference is the right of a stockholder to receive a certain percentage of proceeds upon liquidation. Such proceeds are received in preference over the common stockholders of the liquidating company. It is the protection right enabling preferred stock investors to recover the invested amount before equity stockholders.

Note that the capital structure of a startup comprises common stock as well as preferred stock. Accordingly, the management team and employees hold common stock whereas the investors hold preferred stock that is convertible into common stock.

Remember, that the preferred stock provides liquidation rights to the stockholders. As mentioned earlier, these rights determine the allocation of proceeds among investors and the management team as well as employees in case the company is either sold or liquidated.

Now, there can be situations where these liquidation rights can have an adverse impact on the incentives that the management team and employees would receive. Also, it can create conflicting interests among investors, thereby acting as an impediment to maximizing a firm’s value.

[monsterinsights_popular_posts_inline]

Forms of Liquidation Preference Clause

The liquidation rights of investors can take two forms. These include Initial Liquidation Preference and Participation Rights. Note that the preferred stock can carry an initial liquidation preference alone or can carry an initial liquidation preference plus participation right.

1. Initial Liquidation Preference

This is a preferred stockholder’s right to receive a particular amount per share before any payments are made to the common stockholders. It is designed in such a way so as to give preferred stockholders the ability to recover the invested amount before the common stockholders in the event of liquidation of a company.

Accordingly, the common stockholders would get nothing if the liquidation proceeds are less than or equal to the total amount payable under the preferred shareholders’ initial

liquidation preferences. And the preferred shareholders would receive the proceeds in proportion to their liquidation rights.

Note that the preferred shareholders would not receive the proceeds based on their ownership percentage.

This means the initial liquidation preferences of all the preferred stockholders determine the valuation at which the common stockholders can earn a return upon the company’s liquidation. In that event, the common stockholders would earn a return on their investment so long as the company sells at an amount more than the total cash invested.

Thus, a liquidation preference represents two important elements. The first element refers to the amount of initial preference. And the second element includes the participation of an investor in the proceeds to be distributed to the stockholders in excess of the initial preference amount.

Let’s understand this with the help of an example.

1x Liquidation Preference Example

Say, for instance, a venture capitalist firm ‘VC Funds’ invests US$ 100,000 in a CRM software startup with a 1x preference. Accordingly, in the event of liquidation, ‘VC Funds’ would receive the first US$ 100,000 of the payable proceeds before any other shareholder. This is because such an amount represents the initial preference element of the liquidation preference.

In case, ‘VC Funds’ would have invested US$ 100,000 with a 2x liquidation preference multiple, it would have received the first US$ 200,000 of the payable proceeds before any other shareholder.

Likewise, say ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x liquidation preference multiple. And the proceeds available for distribution to the stockholders at the company’s liquidation amount to US$ 200,000. In this case, ‘VC Funds’ would get a guaranteed amount of US$ 100,000 of the total proceeds.

But, if available proceeds at the company’s liquidation amounted to US$ 90,000, then the investor would get the entire US$ 90,000 proceeds. While other investors would receive nothing. This is because the amount of US$ 90,000 falls under the guaranteed US$ 100,000 in the Initial Liquidation Preference.

2x Liquidation Preference Example

Using the same example as above, say ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 2x liquidation preference multiple. And the proceeds available for distribution to the stockholders at the company’s liquidation amount to US$ 200,000. In such a case, the investor would receive US$ 200,000 despite investing only US$ 100,000 before the common stockholders receive anything.

[monsterinsights_popular_posts_inline]

2. Liquidation Preference Plus A Participation Right

As mentioned earlier, the second element of a liquidation preference is an investor’s participation in the distribution of sale proceeds in excess of the initial preference amount.

Let’s consider the above example once again. Say, ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x preference multiple. And the proceeds available for distribution to the stockholders at the company’s liquidation amount to US$ 500,000. In this case, ‘VC Funds’ would get a guaranteed amount of US$ 100,000 of the total proceeds. But what about the remaining US$ 400,000? How would the remaining US$ 400,000 be shared?

This will depend upon the preferred shareholders’ participation and conversion rights once their initial liquidation preferences are fulfilled.

Participation rights enable preferred stockholders to share the sale proceeds on a pro-rata basis with the common stockholders. Such sale proceeds are distributed as though the preferred stocks are common stocks.

There are two types of participation rights in a liquidation preference. These include participating and non-participating.

a. Non-Participating Preferred Stock

A liquidation preference that is non-participating enables an investor to recover the initial liquidation preference only.

This means once a non-participating preferred stockholder receives the initial preference, the remaining proceeds will be shared between the rest of the stockholders.

Using the above example, say ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x liquidation preference multiple. And the proceeds available for distribution to the stockholders at the company’s liquidation amount to US$ 500,000.

Since the initial liquidation preference is non-participating in nature, ‘VC Funds’ would receive the first US$ 100,000 of the payable proceeds before any other shareholder. The remaining US$ 400,000 would be shared between the rest of the stockholders.

Note that a non-participating liquidation preference works in the favor of founders. Let’s understand this using the above example.

Non-Participating Liquidation Preference Example

Say ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x liquidation preference multiple. In return, such an investor gets 20% of the fully diluted equity.

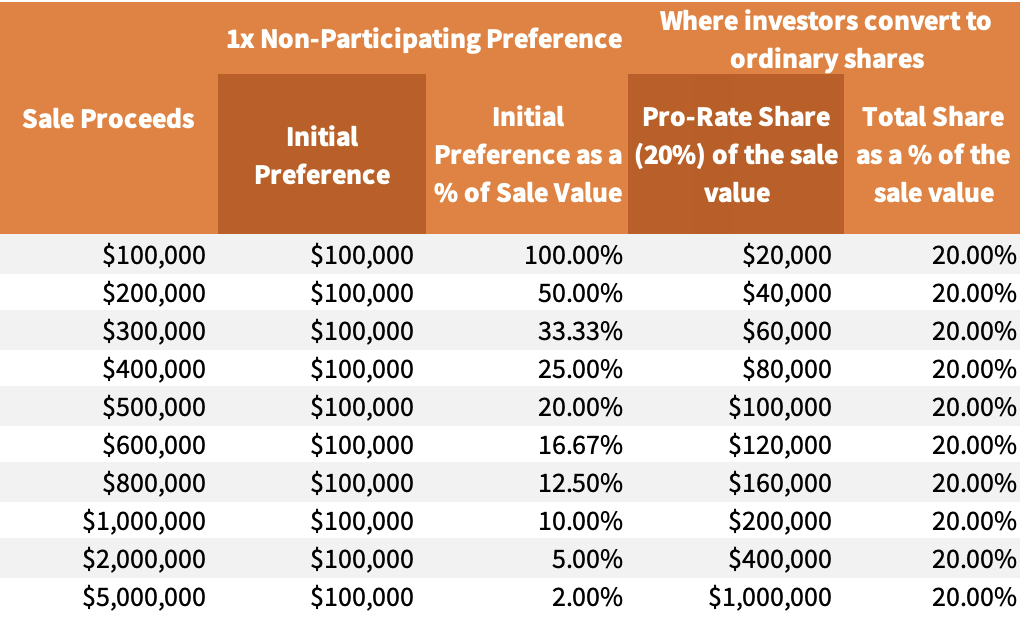

The following table represents the percentage of the sale proceeds ‘VC Funds’ will receive in case of different sale values on a 1x initial liquidation preference multiple.

Note that ‘VC Funds’ will receive only the value of the initial liquidation preference of US$ 100,000 in case of non-participating preference stock. Also, such an investor will need the right to convert its preference shares into ordinary shares before the liquidation event.

[monsterinsights_popular_posts_inline]

Sale Proceeds Scenarios On A 1x Initial Liquidation Preference Multiple

The above table showcases that a non-participating preference will protect an investor whenever the company will perform poorly. For instance, all sale value proceeds below or equal to $ 500,000.

In case, the investor does not have the right to convert into ordinary shares, it would prevent him from taking advantage of the upside when the company performs well. For instance, all sale value proceeds greater than $ 500,000.

Thus, the investor will preferably forego his right to a non-participating liquidation preference and convert into ordinary shares generating proceeds in excess of $ 500,000.

b. Participating Preferred Stock

The second type of participation right in a liquidation preference is participating. A liquidation preference that is participating enables an investor to recover the initial liquidation preference before the other stockholders.

In addition to this, a participating preferred stockholder also gets entitled to participate in the distribution of the remaining sale proceeds along with the rest of the stockholders. Such proceeds are distributed on a pro-rata basis, depending upon the percentage of stocks an investor holds in the company.

Unlike non-participation preference, a participating liquidation preference works in the favor of an investor.

Participating Liquidation Preference Example

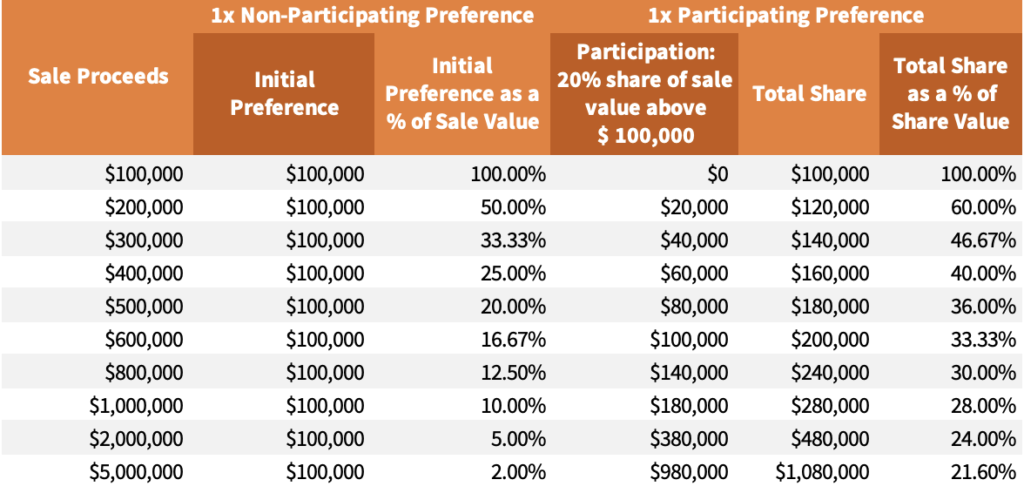

Say ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x liquidation preference multiple. In return, such an investor gets 20% of the fully diluted equity.

The following table represents the percentage of the sale proceeds ‘VC Funds’ will receive in case of different sale values on a 1x initial liquidation preference multiple.

Note that ‘VC Funds’ will receive the value of the initial liquidation preference of US$ 100,000 as well as the value of participation. In this case, the value of participation is 20% of the sale value over and above US$ 100,000.

Sale Proceeds Scenarios On A 1x Initial Liquidation Preference Multiple

As showcased in the table above, the participating preference has a great impact on the proceed distribution when the company performs poorly or moderately. But, the participating preference has less impact on the proceed distribution when the company performs well in terms of generating revenues.

Accordingly, the investor receives a hike of just 1.6% against its equity stake of 20% in the case of participating preference when the sale value is $ 5,000,000. Whereas, the same investor receives a hike of 60% when the sale proceeds are $ 200,000.

[monsterinsights_popular_posts_inline]

3. Level of Seniority

There can be scenarios where the later-stage investors may negotiate an initial liquidity preference that is senior to the preferences of the early-stage investors. Thus, it’s important for an early-stage investor to know the seniority structures as it will help him determine where he falls in the payout order.

There are typically three types of seniority levels. These include Standard Seniority, Pari Passu, and Tiered.

Standard Seniority

In this seniority structure, the liquidation preference payouts are made in order from the latest round to the earliest round. It means in the case of a company’s liquidation, Series B investors will receive their complete liquidation preference before Series A investors.

Pari Passu

In this structure, all the preferred stockholders have the same seniority status irrespective of their class of preferred shares. This means that each and every investor would receive some share, not necessarily equal, out of the total proceeds.

In case the sale proceeds are not sufficient to cover all the investors in case of a pari-passu payout, the proceeds are distributed pro-rata to the capital invested by each investor.

Tiered

This is a type of hybrid seniority structure that falls between the standard seniority and the pari passu design.

4. Cap

As mentioned earlier, liquidation preferences are designed to protect the investors. But, there can be scenarios where a liquidation preference, particularly a participating liquidation preference, can work against the founders as well as the existing shareholders.

Thus, caps on capital were designed to protect the founders in such scenarios. Say, ‘VC Funds’ invests US$ 100,000 in the CRM software startup with a 1x liquidation preference multiple on a 3X cap.

This means such an investor can receive up to US$ 300,000 in total proceeds (US$ 100,000 initial liquidation preference + US$ 200,000 in participation). Provided he does not convert.

In case, the investor wants to get a payout higher than the cap, he must fully convert his preferred shares to common shares.

[monsterinsights_popular_posts_inline]

Final Thoughts

Liquidation Preference is an important provision for investors investing in startups or existing companies. It provides them security on the risk they take in committing a large amount of capital towards a company or business. In fact, such a provision helps businesses in determining the payout order as well as the payout amount that investors would receive in the case of a successful exit.